10xTravel is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or may no longer be available. The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. You can view current offers here.

Launched in August 2018, the Marriott Bonvoy program has come a long way from its separate legacy programs. It merged Marriott Rewards, The Ritz-Carlton and the Starwood Preferred Guest programs into one complete hotel rewards scheme known as Marriott Bonvoy.

With Marriott Bonvoy, you can enjoy tons of benefits and perks from Marriott’s 30 brands and more than 8,000 properties across 139 countries and territories. You’ll earn exclusive amenities and offers as well as complimentary internet and meals from Marriott-owned budget hotels and luxurious resorts worldwide. You also can transfer points to a long list of frequent-flyer programs and use them to book award flights.

One of the best things about the Marriott Bonvoy program is that it offers you great flexibility when it comes to earning redeemable points. The hotel chain has partnered with two of the largest credit card issuers: American Express and Chase. By signing up for one of Marriott’s co-branded credit cards, you can gain access to some amazing perks within the Marriott Bonvoy program.

Chase Marriott Bonvoy Cards

Chase issues three Marriott Bonvoy-branded credit cards that are open to new applicants. All three of these cards are personal credit cards. Chase doesn’t currently issue any Marriott Bonvoy-branded business credit cards that are open for applications.

You don’t have to worry about foreign transaction fees with any of these cards because these charges are waived on purchases made outside of the United States.

Even better, Bonvoy points don’t expire as long as your card has been active in the past 24 months. You’ll also have access to Chase’s 24/7 Visa Signature® Concierge Service for tickets to various culinary and cultural experiences.

Chase gives you tons of reimbursements to ensure that your trips are hassle-free. Travel perks include compensation for baggage delays, damage and flight delays.

Marriott Bonvoy Boundless® Credit Card

If you’re looking for an annual free night certificate at an affordable price, the $95 Marriott Bonvoy Boundless® Credit Card may be your perfect match.

Apart from the welcome offer, you’ll earn 3X Bonvoy points on dining, grocery and gas (on the first $6,000 in combined purchases per year), unlimited 6X points at Marriott properties and 2X points on everything else. You’ll also be eligible to earn one elite night credit toward status for every $5,000 you spend and 15 elite night credits every cardmember anniversary.

You’ll also receive one free night certificate worth up to 35,000 Bonvoy points on your cardmember anniversary, and all Boundless cardmembers receive automatic Silver Elite status.

Marriott Bonvoy Boundless® Credit Card

Earn 5 Free Night Awards

(each night valued up to 50,000 points) after spending $5,000 on eligible purchases within 3 months of account opening. Certain hotels have resort fees.

Annual Fee: $95

Marriott Bonvoy Bountiful™ Credit Card

The $250 annual fee Marriott Bonvoy Bountiful™ Credit Card is Chase’s mid-tier Marriott Bonvoy card. It earns 4X points on groceries and dining (on up to $15,000 in combined purchases per year), 6X points at Marriott properties and 2X points on everything else.

You might have noticed that these spending bonuses are only marginally better than those offered by the Boundless Card. However, where the Bountiful Card really makes up for the elevated annual fee is in its benefits.

This card offers automatic Gold Elite status, 1,000 bonus points every time you stay at a participating Marriott Bonvoy property, 15 elite night credits every cardmember anniversary and an annual free night certificate worth up to 50,000 Bonvoy points.

Marriott Bonvoy Bold® Credit Card

The Marriott Bonvoy Bold® Card doesn’t charge an annual fee, making it a great option for those who want to earn no-strings-attached rewards in the Marriott Bonvoy program.

This card offers 3X points at Marriott properties, 2X points on other travel purchases (from airfare to taxis and trains) and 1X point on everything else.

You’ll also receive 15 elite night credits annually, which automatically qualifies you for Silver Elite status and puts you just 10 more elite nights away from earning Gold Elite status. The Bonvoy Bold Card (like all other Bonvoy cards) doesn’t charge foreign transaction fees.

Marriott Bonvoy Bold® Credit Card

Earn 60,000

Bonus Points plus 1 Free Night Award

after spending $2,000 on purchases in the first 3 months from account opening. Free Night Award valued up to 50,000 points. Certain hotels have resort fees.

American Express Marriott Bonvoy Cards

American Express also has three co-branded credit cards under the Marriott Bonvoy umbrella that are open to new applicants, including two consumer cards and one business card. So, if you’re looking to get a Marriott business card, you’ll probably need to get an Amex card.

Although there was a time when Amex cards weren’t accepted by a large number of vendors, Amex representatives have recently claimed that 99% of U.S. merchants who accept credit cards now also accept Amex.

Each of these cards waives foreign transaction fees and offers complimentary in-room Wi-Fi access. Plus, Amex allows you to pay for purchases made on these cards over time using their payment plan system known as Plan It®.

Marriott Bonvoy Brilliant® American Express® Card

The Marriott Bonvoy Brilliant® American Express® Card charges an annual fee of $650 (see rates & fees) and is Amex’s top-of-the-line Marriott Bonvoy card. Obviously, you’d expect that this card would come with tons of premium perks to make up for that price tag.

In terms of spending bonuses, this card earns 6X points at Marriott hotels, 3X points at restaurants worldwide and flights booked directly with airlines, and 2X on all other purchases.

It also awards you one free night certificate worth up to 85,000 points every year you renew the card, up to $300 in statement credits per calendar year (up to $25 per month) for eligible purchases at restaurants worldwide and a $100 property credit (for qualifying charges at The Ritz-Carlton or St. Regis). You’ll also receive automatic Platinum Elite status and 25 elite night credits to help you achieve the next elite status tier.

If you spend more that $60,000 on your card in a calendar year (which is a pretty lofty threshold), you’ll be able to select an Annual Choice Award, which can be five Suite Night Awards (essentially, five upgraded nights from standard rooms to suites), another free night worth up to 85,000 points or $1,000 off a bed from Marriott Bonvoy Boutiques.

One of the best perks of this card, though, is the complimentary membership to Priority Pass Select, which comes with unlimited to free access to more than 1,300 airport lounges around the world.

Marriott Bonvoy Brilliant® American Express® Card

Earn up to 150,000

Marriott Bonvoy® bonus points

Earn 100,000 points after you spend $6,000 and an extra 50,000 points after you spend an additional $2,000 in purchases on the Card within your first 6 months of Card Membership.

Annual Fee:

$650

Marriott Bonvoy Bevy® American Express® Card

Marriott and Amex recently released a middle-tier card, known as the Marriott Bonvoy Bevy® American Express® Card, with a $250 annual fee (rates & fees).

This card offers 6X points at Marriott properties, 4X points at restaurants worldwide, including takeout and delivery in the U.S. and U.S. supermarkets (on up to $15,000 in combined purchases per year) and 2X points on all other purchases with the Marriott Bonvoy Bevy Card.

The Bevy Card also comes with automatic Gold Elite status as well as 15 elite night credits, which will get you even closer to achieving the next elite status tier. You’ll also receive a yearly free night award worth up to 50,000 points and earn 1,000 bonus points every time you stay at a Marriott location.

Marriott Bonvoy Bevy® American Express® Card

Earn up to 135,000

Marriott Bonvoy® bonus points

Earn 85,000 points after you spend $5,000 and an extra 50,000 points after you spend an additional $2,000 in purchases on the Card within your first 6 months of Card Membership.

Annual Fee:

$250

Marriott Bonvoy Business® American Express® Card

With the Marriott Bonvoy Business® American Express® Card, which charges a relatively modest annual fee of $125 (see rates & fees), you’ll receive one free night worth up to 35,000 Bonvoy points every account anniversary.

It also earns 6X points at Marriott Bonvoy program properties and 4X points at restaurants worldwide and U.S. gas stations, as well as U.S. shipping and with mobile service providers. After that, you’ll earn 2x Marriott Bonvoy Business® American Express® Card points on all other eligible purchases.

The card also comes with automatic Gold Elite status and 15 elite night credits every year.

Marriott Bonvoy Business® American Express® Card

Earn 3 Free Night Awards

after you use your new Card to make $6,000 in eligible purchases within the first 6 months of Card Membership. Each Free Night Award has a redemption level up to 50,000 Marriott Bonvoy® points, for a total potential value of up to 150,000 points, at hotels participating in Marriott Bonvoy®. Certain hotels have resort fees. Terms apply.

Annual Fee:

$125

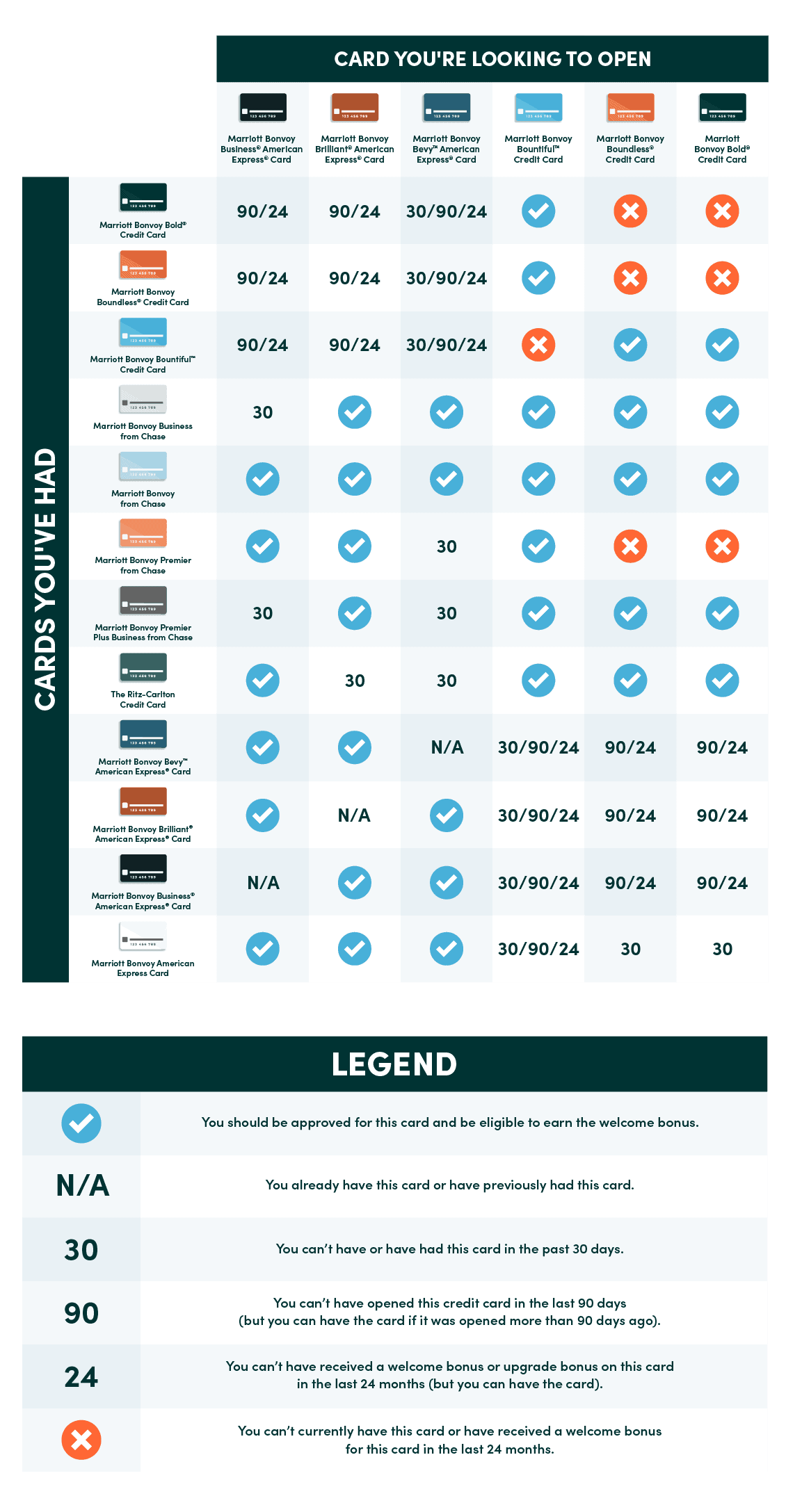

Marriott Bonvoy Card Eligibility Rules

There are a lot of rules to follow when it comes to being eligible for a Marriott Bonvoy card. You have bank-specific rules, but also rules that span across various products—both old products that are no longer available and new ones. Let’s just say, it can get really complicated really quickly.

There are four rules that can apply to cards. These are general rules, and you need to see which ones apply to your specific situation in the table below.

- You’re ineligible for the welcome offer on a card if you have another Marriott card open.

- You’re ineligible if you’ve opened another Marriott card in the past 30 days.

- You’re ineligible if you’ve opened another specific Marriott card in the past 90 days.

- You’re ineligible if you’ve received the bonus on another specific Marriott card in the past 24 months.

Some variation of these rules applies to every Marriott card depending on what cards you have now or have opened in the past.

To simplify it, we’ve put together the chart below that you can reference to determine which rules apply. Simply look at the card you want to open at the top and then reference the cards you currently have or have had in the past on the left to determine which eligibility rules apply.

Each of these cells will contain a code that will tell you what eligibility rules apply to you. Here are the codes and what they indicate:

- OK: You should be approved for this card and be eligible to earn the welcome bonus.

- N/A: You already have this card or have previously had this card.

- 30: You can’t have or have had this card in the past 30 days.

- 90: You can’t have opened this credit card in the last 90 days (but you can have the card if it was opened more than 90 days ago).

- 24: You can’t have received a welcome bonus or upgrade bonus on this card in the last 24 months (but you can have the card).

- Close: You can’t currently have this card or have received a welcome bonus for this card in the last 24 months.

You probably noticed that the six cards along the top of that chart are the cards that are open to new applicants. However, along the left side of the chart there are many cards that aren’t open to new applicants. These cards can still affect whether or not you’re eligible for new cards or new welcome bonuses.

So, you should make sure to look at any past accounts you’ve had and find the dates when you closed those accounts or find the dates when you received any past welcome bonuses from any of these cards. If you don’t know where to find this information, you can always call the customer service line for the card’s issuer (either Amex or Chase).

It’s also worth noting that some of these cards have changed names over time, namely, the Starwood Preferred Guest family of cards. Before Starwood Preferred Guest was acquired by Marriott, the program had its own family of credit cards issued by American Express. But after the merger, some of these cards were renamed and converted to Marriott Bonvoy cards.

Here are the cards that changed over:

- The Starwood Preferred Guest Card from American Express changed to the Marriott Bonvoy American Express Card (no longer open to new applicants).

- The Starwood Preferred Guest Luxury Card from American Express changed to the Marriott Bonvoy Brilliant American Express Card.

- The Starwood Preferred Guest Business Card changed to the Marriott Bonvoy Business American Express Card.

So, if you’ve held any of the aforementioned Starwood cards in the past, you should search for their new Marriott Bonvoy-branded names in the chart above to see how they affect your eligibility.

Generally speaking, these rules don’t seem to follow any sort of rhyme or reason and they’re extremely confusing to keep track of. But if you don’t feel like trying to decipher the chart above, then it’s worth noting that both Chase and Amex have card bonus qualification tools on their websites that can help you determine whether you can be approved for a certain card and earn the welcome bonus. It’s a good idea to reference the chart above and/or use these tools before applying for a card, which involves a credit inquiry that can affect your credit score.

Chase Marriott Bonvoy Card Eligibility Rules

On top of the rules laid out by Marriott for card eligibility, Chase has general card eligibility terms for all its credit cards. So, if you’re looking into getting a Marriott Bonvoy card that’s issued by Chase, you’ll need to pay attention to these rules as well. In particular, you may want to consider the 5/24 rule and the 24-month rule before applying.

The so-called “5/24 rule” states that you won’t be eligible to open a new account with Chase if you’ve opened five or more credit cards with any bank within the past 24 months. This rule has never been explicitly stated by Chase. However, crowd-sourced data leads us to believe that Chase uses this criteria to decide your eligibility.

The 5/24 rule applies to all personal credit cards (regardless of the issuer and whether you’ve since closed those accounts) and also applies to certain business cards. To see which cards contribute to your 5/24 rule status, check out our “Beginners Guide to the Chase 5/24 Rule.”

It’s worth noting that if you’re currently over the 5/24 limit, then you could still qualify for one of the Marriott Bonvoy cards issued by American Express.

The so-called “24-month rule” is another unwritten rule that states that you won’t be eligible to receive a welcome bonus if you already hold the same card or have already gotten the same offer in the past two years. For instance, if you received a welcome bonus from the Marriott Bonvoy Bold card less than 24 months ago, then you won’t be eligible to receive another welcome bonus from the Marriott Bonvoy Bold Card until that 24-month period has passed.

Apart from their general eligibility terms and conditions, Chase-issued Marriott Bonvoy cards also aren’t available to current and previous cardmembers of the same credit card in the past 24 months. Nonetheless, you can request a product change if you’d like to shift from one personal Marriott Bonvoy card to another.

You also aren’t eligible for a Chase-issued Marriott Bonvoy card if you have or have had an Amex-issued Marriott Bonvoy card within the last 30 days.

American Express Marriott Bonvoy Card Eligibility Rules

American Express also has several card and welcome bonus eligibility terms that you should consider before applying for any of its Marriott Bonvoy cards. These rules cover the number of credit cards you’ve opened and closed. Regardless, following them gives you a higher chance of getting your application approved.

For one, the “five-card rule” states that you can hold no more than five personal and business American Express credit cards at a time. So, if you’ve already got five Amex credit cards in your wallet, then there’s a high likelihood that you won’t be approved for the Marriott Brilliant, the Bevy or the Bonvoy Business cards from American Express.

You also can’t open two Amex cards within five days or more than two cards within 90 days. Additionally, you can’t be a current cardholder or have been a cardholder of a Chase-issued Marriott Bonvoy card within the last 90 days.

In terms of its welcome offers, you’re eligible for a Marriott Bonvoy welcome offer only if you haven’t received an offer on the same card in the past. That also applies to the Starwood Preferred Guest cards that have been rebranded. For instance, if you’ve received a welcome bonus from the SPG Luxury Card in your lifetime, then you aren’t eligible for a welcome bonus from the Marriott Bonvoy Brilliant Card.

Alternatively, your application may not get approved if you’ve already obtained a new

cardmember bonus or upgrade from Chase within the last 24 months.

What Makes the Marriott Bonvoy Program Popular

As a member of the Marriott Bonvoy loyalty program, you can redeem points for free stays and complimentary packages from more than 30 hotel brands. That equates to VIP experiences and rooms in more than 8,000 hotels, resorts, residences and extended stay properties in 139 countries and territories.

There are five elite status tiers that you can earn by staying at Marriott properties,

- Silver Elite

- Gold Elite

- Platinum Elite

- Titanium Elite

- Ambassador Elite

You can earn some of these elite tiers by holding a co-branded Marriott credit card. They all have different perks, so it’s worth looking into each tier before applying for a Marriott Bonvoy credit card from Chase or American Express.

Member

By default, all eligible Marriott Bonvoy program members get free Wi-Fi in all their rooms. You can also use your mobile phone to check in and check out and as a room key. You can even spend your points on meals, cocktails and spa experiences.

Silver Elite

If you’ve stayed 10 nights in a calendar year, you earn the Silver Elite status, which comes with slightly more benefits. You can also achieve this status tier by signing up for either the Marriott Bonvoy Bold or the Boundless Card.

Silver Elite members earn 10% more points on hotel purchases and enjoy priority late checkout. You’re also eligible for the Ultimate Reservation Guarantee that compensates you for a reservation that can’t be honored.

Gold Elite

Their next tier starts at 25 nights in a calendar year. You can also achieve Gold Elite status automatically by signing up for the Marriott Bonvoy Bountiful, the Bevy or the Bonvoy Business Card. Additionally, if you hold The Platinum Card® from American Express, you qualify for Marriott Gold Elite status as well (enrollment required).

As a Gold Elite member, you’ll earn 25% more points on hotel spend with a chance to upgrade your room. You can also check out as late as 2 p.m. and are eligible for a welcome gift of 250 to 500 points, depending on the property.

Platinum Elite

After staying 50 nights per year, you’ll reach the Platinum Elite level. You can also achieve this status tier automatically by signing up for the Marriott Bonvoy Brilliant Card.

At this tier, you’ll earn 50% more points on hotel purchases and receive a welcome gift, such as points, free breakfast or exclusive amenities.You can also upgrade your room to a suite and earn an annual gift choice, such as suite night awards, gift of status or a discount on a bed.

Platinum Elite members have free lounge access with complimentary breakfast. The late checkout benefit lets you check out of your room at 4 p.m. (when available). You’ll also get access to a dedicated 24/7 elite support team to assist you with your needs.

Titanium Elite

The Titanium Elite status tier begins at 75 nights per year. It lets you earn 75% more points on spending at Marriott Bonvoy properties and enjoy a 48-hour guarantee for all your bookings. That means a room should be available to you even within 48 hours of booking. This status level also rewards you with a complimentary United MileagePlus Premier Silver status.

Ambassador Elite

With at least 100 nights per year and a $20,000 annual qualifying spend, you’ll be eligible for Marriott’s top-tier ambassador service and flexibility to choose your own 24-hour check-in and checkout time.

Final Thoughts

In conclusion, getting a Marriott Bonvoy co-branded credit card might be a good idea for those who stay at Marriott properties often. A total of six Marriott cards are accepting new applicants: three cards from Chase and three from American Express. Amex is even offering a Marriott Bonvoy business credit card for those who want to earn Bonvoy points while operating their small business.

However, which of these cards you’re eligible for depends on a long list of rules (set by Marriott, Chase and Amex independently) that’s incredibly difficult to understand. So, even if you have an excellent credit score, you may be surprised to learn that you don’t qualify for a new Marriott Bonvoy card. And applying for a new credit card (whether you’re approved or not) involves a hard credit inquiry, which will cause a temporary drop in your credit score.

So, it’s best to avoid applying for cards that you won’t be approved for, which is why it’s important to understand the eligibility requirements for Marriott Bonvoy cards. By referencing the chart above (as well as the specific eligibility rules from Chase and Amex), you can determine which cards and welcome bonuses you’re eligible for. That way, you can avoid getting denied a new Marriott Bonvoy credit card and dropping your credit score for no reason.

New to the world of points and miles? The Chase Sapphire Preferred® Card is the best card to start with.

With a bonus of 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening. , 5x points on travel booked through Chase Travel℠ and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

(each night valued up to 50,000 points) after spending $5,000 on eligible purchases within 3 months of account opening. Certain hotels have resort fees.

after spending $2,000 on purchases in the first 3 months from account opening. Free Night Award valued up to 50,000 points. Certain hotels have resort fees.

Earn 100,000 points after you spend $6,000 and an extra 50,000 points after you spend an additional $2,000 in purchases on the Card within your first 6 months of Card Membership.

after you use your new Card to make $6,000 in eligible purchases within the first 6 months of Card Membership. Each Free Night Award has a redemption level up to 50,000 Marriott Bonvoy® points, for a total potential value of up to 150,000 points, at hotels participating in Marriott Bonvoy®. Certain hotels have resort fees. Terms apply.

Editors Note: Opinions expressed here are author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.