10xTravel is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This site may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the 10xTravel team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

Note: Some of the offers mentioned below may have changed or may no longer be available. The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. You can view current offers here.

Amazon Prime Day is almost upon us. This yearly event includes exclusive discounts and deals for Amazon Prime members across more than 35 categories, including electronics, kitchen, beauty and apparel. This year, Prime Day will be taking place July 8 through July 11, which makes this a great opportunity to get back-to-school shopping done early and affordably.

So, if you’re a 10xTravel reader, you’re probably wondering how to get the most out of Prime Day. For one, if you sign up and are approved for the Prime Visa (issued by Chase), you’ll instantly get a an Amazon gift card, which you can use to take advantage of great deals on Prime Day. Additionally, this card offers excellent rewards on Amazon.com spending, meaning you’ll earn tons of cash back on your Prime Day purchases.

Let’s go over a few Prime Day tips to help you save money and maximize the rewards you can earn during this amazing online shopping event.

Unlock Prime Day’s Hidden Credit Card Benefits

Of course, the discounts and deals offered on Amazon Prime Day should be enough to catch your attention if you have some purchases that you need to make. In fact, according to Capital One Shopping, the average discount on Prime Day 2024 was 18%, which is significant.

However, by choosing the right credit card for your Prime Day purchases, you can combine these discounts with valuable credit card benefits, such as:

- Welcome bonuses

- Spending bonuses

- Extended warranty protection

- Purchase protection

- Return protection

As you can see, when you take advantage of Prime Day credit card deals, your purchases will be protected and will help you earn valuable cash back or rewards points.

Combine Credit Card Rewards with Prime Day Deals

One of the things about using a rewards credit card for your Prime Day purchases is that you’ll essentially be able to stack your Prime Day deal savings with the savings you receive from credit card cash back and points bonuses.

For example, one of the deals to be offered on Prime Day 2025 is a discount of up to 50% on certain electronics, including the Ring indoor camera. If you were to purchase this item with the Capital One Venture Rewards Credit Card, which earns 2X miles on all purchases, then you’d essentially be getting an additional 2% discount in the form of Capital One Miles.

By using certain credit cards (especially those that offer 5% cash back on rotating categories that include Amazon purchases), you can get even greater discounts on Prime Day purchases.

Best Credit Cards for Amazon Purchases

Some of the credit cards that offer some of the best bonuses and benefits to take advantage of on Prime Day include:

- Prime Visa

- Capital One Venture Rewards Credit Card

- Blue Cash Everyday® Card from American Express

- Chase Freedom Unlimited®

Explore the following sections to learn about each of these cards’ different features.

Prime Visa

Without question, the best Prime Day credit card deal available is the Prime Visa ($0 annual fee). First of all, as mentioned above, new cardmembers who are approved for this card will instantly receive an Amazon gift card. The gift card will be usable as soon as you’re approved for the card, and those dollars will go a lot further if you spend them on discounted items on Prime Day.

On top of that, the Prime Visa card also offers fantastic spending bonuses on Amazon spending and in other key categories. Here are the current spending bonuses offered by this card:

- 10% cash back or more on a rotating selection of items and categories on Amazon.com with an eligible Amazon Prime membership

- 5% cash back on Amazon.com, Amazon Fresh and Whole Foods Market purchases with an eligible Amazon Prime membership (non-Prime members will earn 3% cash back in these categories)

- 5% cash back on purchases made through Chase Travel℠

- 2% cash back on gas stations, restaurants, and local transit and commuting (including ride-hailing services)

- 1% cash back on all other purchases

On top of all of these valuable benefits, the Prime Visa Card is offering 7% cash back on eligible products with no-rush delivery during Prime Day 2025. Essentially, this means that if you select no-rush delivery on the purchase of an eligible item during Prime Day 2025 and pay with your Prime Visa, you’ll get 7% cash back (instead of the 5% cash back you’d normally get with this credit card).

Additionally, the Prime Visa also includes the full suite of Visa Signature benefits, many of which will help you feel more confident about your purchases on Prime Day. Some of these benefits include:

- Extended warranty protection (extends the manufacturer’s U.S. warranty by an additional year on eligible warranties of three years or fewer)

- Purchase protection (covers your eligible new purchases for 120 days against damage or theft up to $500 per item)

You can get even more value through the Amazon Prime card travel benefits, which include baggage delay insurance, travel accident insurance, lost luggage reimbursement and auto rental coverage. While these benefits may not save you money on Prime Day, they could save you lots of money during your travels.

It’s worth noting that this card doesn’t charge an annual fee. However, to get the full benefits out of this card, you have to have an Amazon Prime subscription, which costs $139 per year.

Capital One Venture Rewards Credit Card

If you aren’t interested in getting a co-branded Amazon credit card, then you may want to consider making your Prime Day purchases with the Capital One Venture Rewards Credit Card ($95 annual fee).

While this card doesn’t have any Amazon-specific spending bonuses, it does earn 2X miles on all purchases, which means you’ll earn 2X Capital One Miles for every dollar spent on Amazon.com.

Here’s a full breakdown of the spending bonuses offered by the Venture Card:

- 5X miles on hotel, vacation rentals and rental car reservations made through Capital One’s travel booking site

- 2X miles on all other purchases

This card also offers special benefits like a $50 experience credit on all bookings made through Capital One’s Lifestyle Collection, a reimbursement credit for the application fee for either TSA PreCheck or Global Entry, automatic Hertz Five Star status and more.

In terms of using this card for Amazon spending, 2X miles is one of the best earning rates that you’ll find on non-bonus spending, and the Venture Card’s annual fee of $95 is relatively low compared to other cards that offer similar benefits and spending bonuses.

The Venture Card is currently offering an especially high welcome bonus for new cardholders, and any purchases you make on Prime Day with this card can help you reach the spending requirement for that welcome bonus.

Unlike the other cards mentioned in this article, the Venture Card earns Capital One Miles, which can be worth several cents apiece when redeemed through Capital One’s 15+ transfer partners. By contrast, cash back is always worth 1 cent apiece.

Blue Cash Everyday® Card from American Express

Apart from the Prime Visa card, the best cashback card to use for Prime Day 2025 is the Blue Cash Everyday® Card from American Express ($0 annual fee, rates & fees). This card earns 3% cash back on up to $6,000 (then 1% thereafter) in purchases made with online retailers annually, including Amazon. So, by using this card on Prime Day 2025, you can stack that 3% cash back with the discounts included in this event for maximum savings to increase your savings.

The Amex Blue Cash Everyday Card also offers great spending bonuses in other categories, including:

- 3% cash back at U.S. supermarkets on up to $6,000 in purchases annually (then 1% thereafter)

- 3% cash back on U.S. online retailers on up to $6,000 in purchases annually (then 1% thereafter)

- 3% cash back at U.S. gas stations on up to $6,000 in purchases annually (then 1% thereafter)

- 1% cash back on all other purchases

Cash back is received in the form of Reward Dollars, which can be redeemed as a statement credit or at checkout on Amazon.com.

The Blue Cash Everyday Card also includes a $7 monthly statement credit on a subscription at selected U.S. entertainment providers. Subject to auto-renewal (enrollment required).

So, not only is this an excellent card to use for purchases on Prime Day 2025 and on Amazon in general, it’s also a great card to use for many of your other purchases. The Blue Cash Everyday Card is also offering a welcome bonus for new cardholders, and your spending on Prime Day 2025 could help you fulfill the spending requirement for this welcome bonus.

Unfortunately, unlike Amex cards that earn Membership Rewards points, the Blue Cash Everyday Card doesn’t give you access to Amex’s transfer partners or to the Amex travel portal.

Chase Freedom Unlimited®

The Chase Freedom Unlimited® is another $0 annual fee credit card that’s a good option for your Prime Day 2025 spending. This card offers 1.5% cash back on every purchase that doesn’t fit into one of its specific bonus categories, including Amazon purchases. These are good rewards for a card that doesn’t have an annual fee.

Here are all of the spending bonuses offered by the Chase Freedom Unlimited® card:

- 3% cash back on dining at restaurants, including takeout and eligible delivery services

- 3% cash back on drugstores

- 1.5% cash back on all other purchases

As you can see, the Freedom Unlimited card earns 1.5% cash back on every purchase you make during Prime Day 2025. Plus, it’s a good card to have for the rest of the year as it also offers 3% cash back on spending at restaurants and drugstores.

Smart Timing for Credit Card Applications

If you plan on applying for a new credit card in advance of Prime Day 2025, there are a few timing considerations.

For one, if you’re planning to use your new credit card to make purchases on Prime Day 2025, you’ll want to research how long it will take your issuer to send you your card or issue you a card number.

Some issuers will issue you a virtual card number before your physical card arrives in the mail. If you are able to get a virtual card number, you’ll be able to use it for Amazon.com purchases on Prime Day. If you’ve been approved for a credit card and you haven’t been issued a virtual card number, it’s worth calling your issuer and requesting one.

Let’s look at some other timing considerations when opening new credit cards.

Optimizing Sign-Up Bonuses

Every credit card mentioned in the sections above (and almost every credit card from a major issuer) offers a sign-up bonus. These offers typically offer a sum of points, miles or cash back to new cardholders who spend a certain amount of money on their card within a certain period of time after account opening. In most cases, you’ll be asked to spend several thousand dollars within a few months to qualify for the bonus.

You don’t want to miss out on these valuable welcome offers. So, before you open a new credit card, you should consider whether you’ll be able to meet the spending requirement for the welcome bonus.

Managing Credit Score Impact

Whenever you apply for a credit card, the issuer performs a “hard inquiry,” which essentially means that they pull your credit reports. Unfortunately, whenever a hard inquiry is performed, your credit score will decrease temporarily.

A hard inquiry will typically cause your credit score to drop by three to five points, and although your credit score may take as long as two years to go back up, it usually only takes about one year.

If you’re going to apply for another line of credit for which the interest rate depends on your credit score (such as an auto loan or a mortgage), then you’ll want your credit score to be as high as possible. For this reason, it’s typically not advisable to apply for a new credit card before applying for another line of credit like an auto loan or mortgage.

Extra Savings with Shopping Portals

Another benefit offered by many credit cards is access to shopping portals, which typically offer coupons or discounts with certain retailers, often including Amazon. These shopping portals are a great place to find coupon codes, many of which can be stacked with Prime Day deals for huge savings.

Let’s look at a few different credit card shopping portals where you can find coupon codes that might save you lots of money on Prime Day.

Best Portals for Amazon

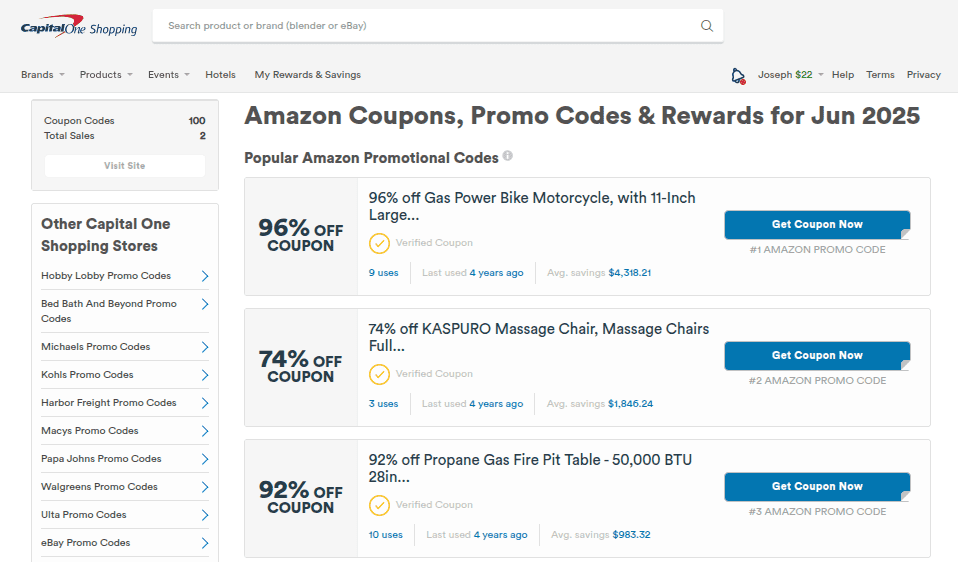

Many major U.S. credit card issuers have their own shopping portals where you can find deals and coupon codes for major retailers like Amazon. Here are a few of the best shopping portals that U.S. credit cardholders should pay attention to:

- Capital One Shopping

- Citi Shop

- Shop Through Chase

All three of these credit card shopping portals offer deals and coupons that can help you save money when shopping through Amazon on Prime Day.

For example, through the Capital One Shopping portal, you can go to the brand page for Amazon and find tons of coupon codes for specific products and product categories, many of which can be stacked with Prime Day deals.

Plus, if you install the Capital One Shopping web extension, these coupon codes will be automatically applied at checkout. So, you may be able to capture even more savings on Prime Day deals without having to do any searching.

It’s worth mentioning that while these portals are great places to find coupon codes and deals that provide upfront savings, they don’t offer any cash back on Amazon purchases. However, a few lesser-known shopping portals allow an opportunity to earn cash back on Amazon purchases (including during Prime Day 2025), such as:

- Mr. Rebates

- BeFrugal

- RebatesMe

Using these shopping portals, you may be able to earn cash back on your Prime Day purchases in addition to any cash back or points you earn with a credit card.

Redeem Statement Credits and Special Offers

Another way that certain credit cards help you save money on Prime Day and when shopping on Amazon in general is by redeeming cash back for statement credits toward Amazon purchases.

For instance, both the Amex Blue Cash Everyday and the American Express Blue Cash Preferred® Card from American Express allow you to redeem your cash back directly for Amazon purchases at checkout. When doing so, each American Express Reward Dollar (which are the rewards earned by both of these cards) is worth exactly $1. So, redeeming your rewards this way provides the same value as if you were to convert your rewards into cash and then spend that cash on Amazon purchases. It’s just quicker and easier.

On the other hand, when redeeming American Express Membership Rewards points (such as you might earn with the American Express® Gold Card, for instance), you’ll get a value of just 0.7 cents per point when redeeming for Amazon purchases. And, when redeeming Capital One Miles, Chase Ultimate Rewards points or Citi ThankYou points for Amazon purchases, you’ll get 0.8 cents per point. Since all of these points are worth considerably more when redeemed in other ways, we recommend not redeeming them for Amazon purchases.

There are also special offers for Amazon purchases available to certain credit cardholders. For instance, if you’re an Amex cardholder, you can go to the Amex Offers section of your account portal and search for Amazon offers. In some cases, you’ll be able to score extra rewards by using your enrolled card on Amazon purchases.

Maximizing Amex Offers

If you’re an Amex cardholder, you should definitely check to see if there are any Amazon deals available to you before you start doing your Prime Day shopping. In particular, for Prime Day 2025, there is an amazing offer where you can save up to 50% on certain items just by redeeming at least one Amex Membership Rewards point through Amazon.

Typically, we advise against redeeming Amex points through Amazon because you’ll get only 0.7 cent per point in value). However, if this offer is available to you, you can redeem just a single point and unlock savings of up to 50% on certain items.

This is a targeted offer, meaning that it won’t be available to all Amex cardholders, but it’s definitely worth checking to see if you’ve been targeted. The best way to do so is to link your Amex card to your Amazon account and then go to amazon.com/amexoffer. If this offer (or a lesser offer) is available, you can activate it and then use it to reap your savings.

Boosting Savings with Chase Offers

Historically, Chase cardholders have also received targeted offers for Amazon purchases. In fact, on Prime Day 2024, certain Chase cardholders received an offer of up to 50% off certain items when they redeemed at least one Chase Ultimate Rewards point toward the purchase.

No reports have been made of a similar targeted offer for Prime Day 2025, but it’s still worth checking the Chase Offers page before you start your Prime Day shopping.

Make the Most of Category Bonuses

On top of all of the other ways to save already mentioned in this article, it’s important to pay attention to the spending categories offered by your credit cards. For instance, if you have one credit card that earns 3% cash back on online retail purchases (such as the Amex Blue Cash Everyday Card) and another card that earns only 1% cash back in this category, make sure that you use the card that earns you more cash back for your Prime Day purchase.

If you have other credit cards, you’ll want to calculate the value of the rewards you’d earn on a specific Amazon purchase with each card before completing that purchase.

Your Prime Day Points and Miles Strategy

Hopefully, after reading this article, you feel prepared to capture the greatest possible savings during the 2025 Amazon Prime Day event through the various strategies we’ve discussed. For one, you can use credit cards that offer elevated spending bonuses on Amazon purchases. You can also use your Prime Day purchases to help earn a credit card’s welcome bonus.

Aside from that, there are several credit card shopping portals through which you can search for coupon codes. These codes can often be stacked with Prime Day deals for maximum savings. Certain credit cardholders may also receive special targeted offers for discounts on Amazon purchases, so you should check your credit card account portal for those types of deals.

Finally, let’s make a brief checklist to ensure that you’re ready for Prime Day 2025.

Pre-Prime Day Checklist

Here are some of the essential tasks you can do to make sure you’re ready to maximize your savings during Prime Day 2025:

- Apply for new credit cards that earn elevated spending bonuses on Amazon purchases.

- Make sure you do this far enough in advance that your card will arrive before Prime Day, or request a virtual card number to use on Prime Day.

- Check any credit card shopping portals for Amazon coupon codes relevant to you.

- Check your email and credit card account for any targeted offers that your credit card issuer may have sent you for Amazon discounts.

- Review the spending bonuses offered by each of your cards to ensure you maximize your rewards for each Prime Day purchase.

- Consider whether you’d like to use any points or miles for statement credits toward your Prime Day purchases.

By using these strategies, you can rest assured that you won’t miss out on any potential savings come Prime Day 2025.

Related Reading: Is the Amazon Business Prime Credit Card Worth It?

New to the world of points and miles? The Chase Sapphire Preferred® Card is the best card to start with.

With a bonus of 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening. , 5x points on travel booked through the Chase TravelSM Portal and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

Editors Note: Opinions expressed here are author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.