10xTravel is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or may no longer be available. The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. You can view current offers here.

So, let me start by saying this: It’s not as bad as it seems.

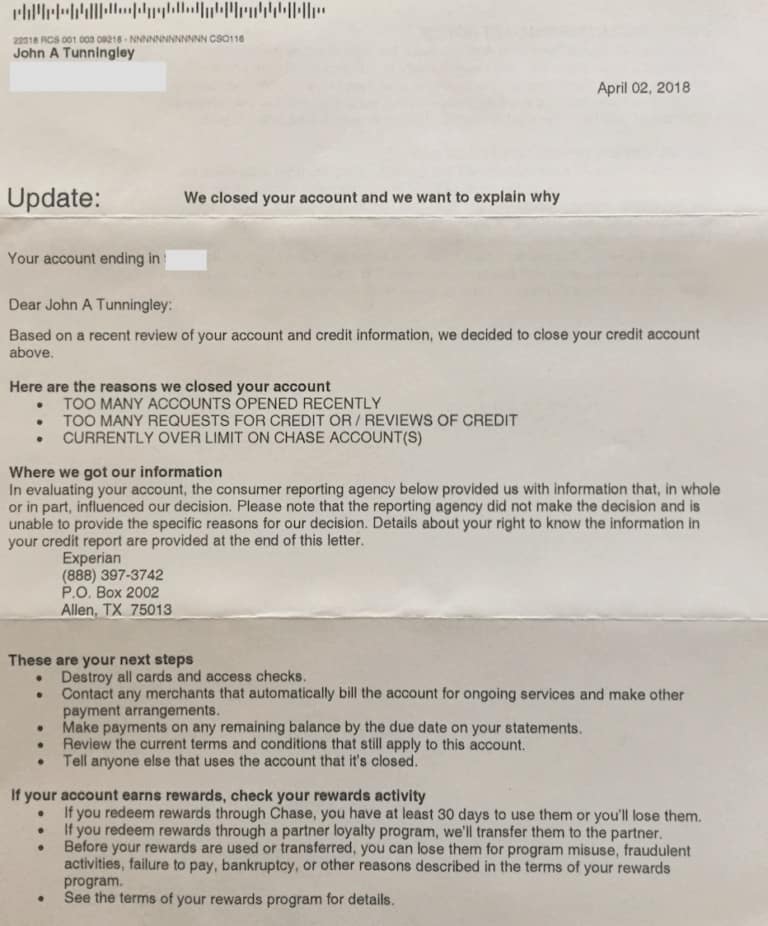

For any of you who might get that awful shutdown letter from Chase, take a deep breath and remember that it’s possible to get the decision reversed.

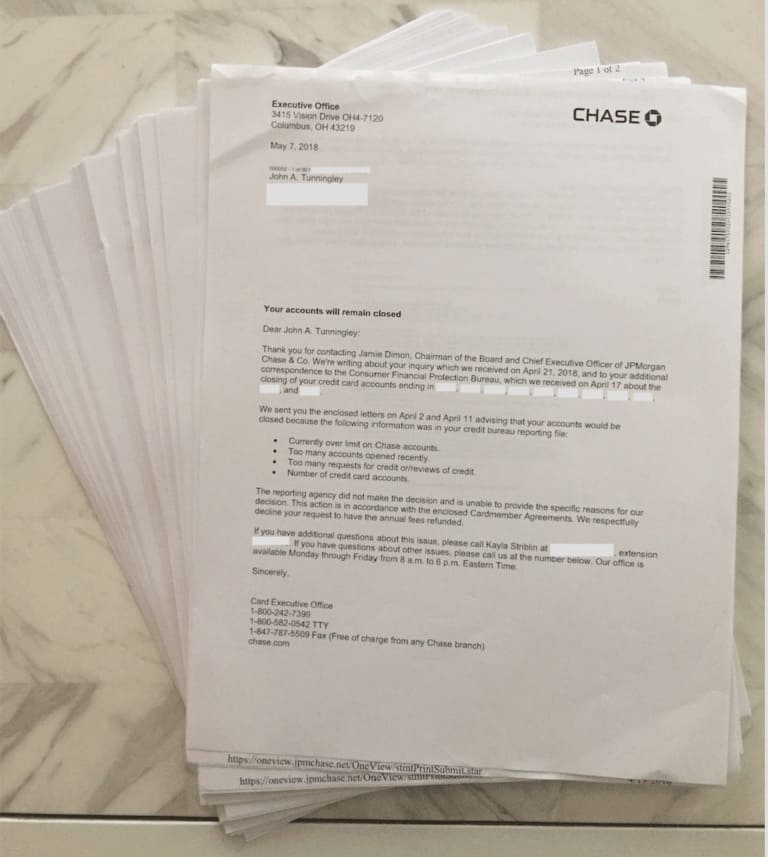

Easily one of the scariest piece of mail I’ve ever received

Before we get into how you can prevent this heartburn, I want to talk about how I ended up being shut down and some of the mistakes I made along the way.

The Backstory

A little over a year ago, I decided to take the leap and really dive into the points and miles world. I had been passively earning points for a while and taking maybe one trip per year on points. Until this point, I probably applied for one card per year.

All that changed when I started to pay a little more attention to the 10xTravel Insider’s Facebook group I had found a few years earlier. I signed up for, and received the 100,000-point bonus for the Chase Sapphire Reserve® when the card was launched (that bonus is no longer available) and the rest is history.

I was applying for a card or two every 45-90 days and played the 5/24 game perfectly. After the Chase Sapphire Reserve®, I applied for the Chase Sapphire Preferred a little over a month later — this is no longer possible.

I then decided to open my first business cards and, less than two weeks after getting the Sapphire Preferred, I applied for the Chase Ink Preferred and the Bank of America Alaska Airlines Business card simultaneously, and then the Starwood Preferred Guest business card a week later.

I wasn’t shut down because I had a single suspicious activity. I was shut down because in the span of a year Chase had extended me well over 6 figures in credit-- I was told this repeatedly when I called to fight my case.

I was approved for both the Ink Preferred (after a recon call) and the Starwood Preferred Guest business cards and on my way to even more points. Needless to say, I started out pretty recklessly but was lucky and was still being approved.

My credit score soared and I continued to apply for additional cards.

A great offer came up for the CitiBusiness AAdvantage Platinum Select card a couple of months later and I jumped on it to earn 75,000 American miles. I then waited another month before applying for the Chase United℠ Explorer Card and the Chase Marriott Rewards Premier card on the same day (while on vacation in Florida) and was instantly approved for both cards.

This brought my Chase card count up to 7 including the Chase Hyatt card I had before I decided to really start collecting points and the Chase Freedom card that I opened at 18. Clearly, this is a lot of cards from one bank but Chase has many of the top recommended cards and I wanted to take advantage of what they had to offer and maximize my 5/24.

However, I started to realize how much credit Chase had extended to me and decided to close the Hyatt card since I had already had it for over 2 years.

My credit score soared and I continued to apply for additional cards.

I waited two more months and decided to go back to the well and applied for the Chase Ink Business Cash. I knew I could utilize the 5X bonus categories and was excited for the opportunity to earn more Ultimate Rewards to pad my account.

I knew I was approaching the day when I’d hit 5 cards within 24 months and be restricted by the Chase 5/24 rule. This was all within 6 months of really getting into points.

This was incredibly reckless on my part and I was turned down for a couple of business cards along the way. But I brushed that off and kept applying anyway.

I stayed steady at 7 Chase cards and took a few months off for the holidays.

Then the new year hit and the Chase Southwest cards offered big new bonuses. I knew that this was my chance to fully maximize 5/24 and hopefully get the famed Southwest Companion Pass in the process. I was instantly approved for both Southwest personal cards, the Southwest Premier Card and the Southwest Plus card — getting two personal Southwest cards is no longer possible.

In celebration of finally being over 5/24, I got a little reckless yet again and applied for a couple more cards on that very same day.

I did all this and was still fine.

At this point, I thought I was bulletproof. I was playing the game and, in my mind, winning it.

Then, about a month later, I found out that the former Chase IHG Rewards Club card was coming to an end. Knowing it offered an annual free night certificate (and not knowing that they were going to dramatically change that benefit), I decided to apply for the Chase IHG Rewards card.

I was instantly approved.

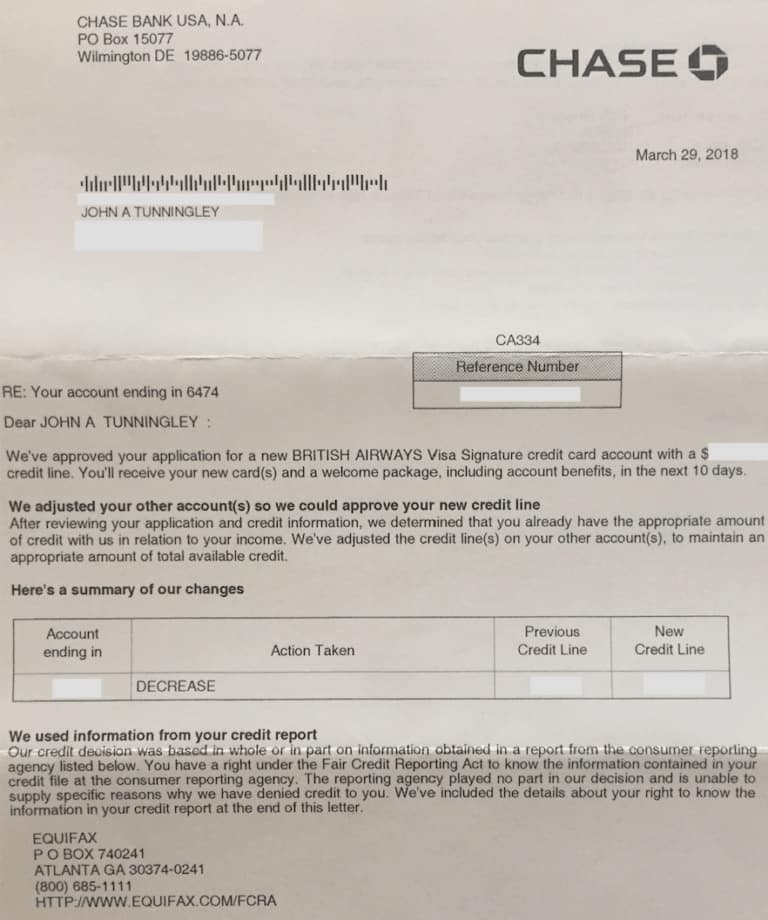

I’m convinced that if I would have stopped there, I would have been fine. Instead, still thinking I was bulletproof, and only seeing people being shut down for missing payments, stopped payments, etc., I decided to apply for the Chase British Airways Visa Signature® Card to combine the two pulls.

My last approval came with a decrease in one of my other accounts

I was not auto-approved but got an email a week after that stating that I had been approved. For those of you keeping count, that brought me up to 11 Chase cards total — 10 of which I had applied for in the span of about a year (and this doesn’t include a couple of Chase Business cards that denied me).

I was foolish and a week later when shopping at Staples my Chase Ink Cash was declined. I tried another Chase card to no avail.

I WAS SHUT DOWN.

Of course, as someone who relied on those cards for just about every trip I’d taken in the past 2-3 years, I had a minor (MAJOR!) freak out. I tried to remain calm knowing that these have been overturned but knew for me it was a longshot.

I wasn’t shut down because I had a single suspicious activity. I was shut down because in the span of a year Chase had extended me well over 6 figures in credit– I was told this repeatedly when I called to fight my case.

I had been reckless.

Although I had seen the fruits of my labor, earning tons of points from sign up bonuses alone within a year, I was also facing the consequences. Chase was finally on to me.

As I tried to fight it and get it overturned, I explained I traveled for work frequently, that I was super responsible, always paid my balances in full and that I was applying for specific cards as I encountered those programs while traveling.

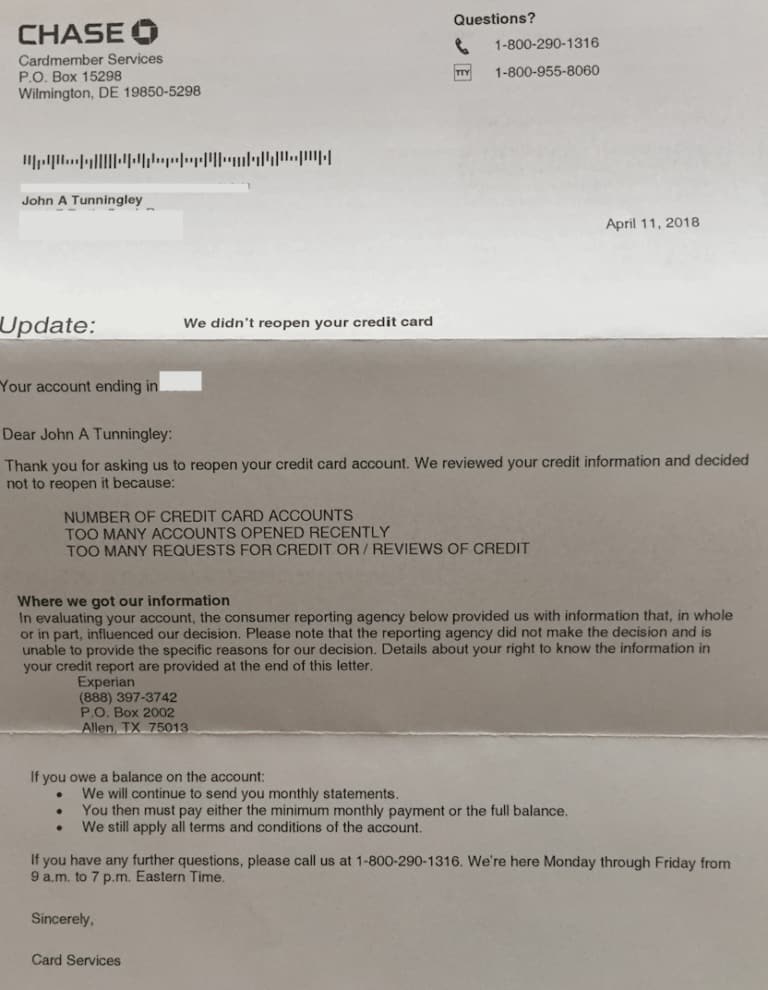

I tried everything I could but to no avail

None of it worked.

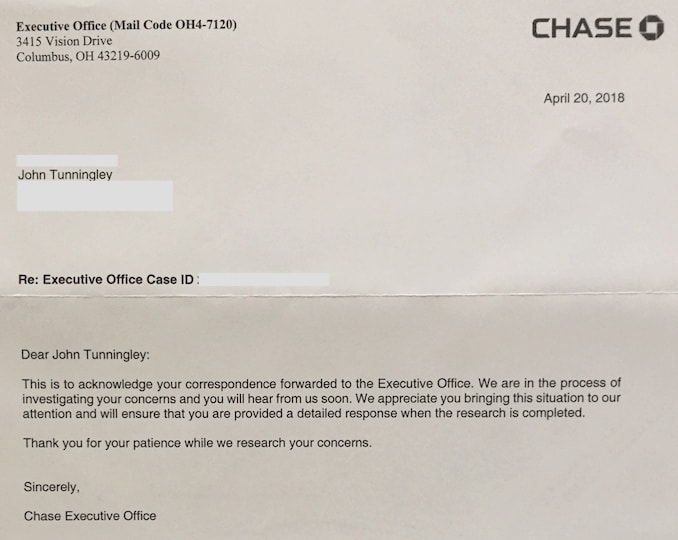

I fought it up and down the Chase corporate ladder going as far as reaching out the Chase’s CEO through email and pleading my case. I even got in touch with the Consumer Financial Protection Bureau. I tried to get just certain cards reinstated, then eventually just my Chase Freedom reinstated to keep my credit history. Unfortunately, my pleas fell on deaf ears.

I was grasping at straws and reached out to Chase’s CEO

I was crushed and thought my life as a points and miles enthusiast was over. Luckily for me, it’s simply changed my outlook on how I approach this hobby. Now, instead of building up an infinite stash of Ultimate Rewards points, I am looking for other opportunities.

The response from the CEO office included every card member agreement

I spend more time combing through every program instead of just one and since I don’t have the benefits that many of the Chase cards offer, I am instead almost always putting my spending towards a different minimum spend. I’ve also changed my focus to creating an effective (not quite so reckless) long-term strategy for my girlfriend and am now taking advantage of a two-player mode.

Key Takeaways

Here are the lessons I learned going through this ordeal which can, hopefully, help you from experiencing my unfortunate fate.

- Don’t be reckless. Use the team at 10xTravel to discuss a strategy and plan that will work for you.

- Remember this is a marathon, not a sprint. Strategy is key. Yes, things are constantly changing but your plans can change as well and the biggest key is having a plan.

- Avoid missed payments, stopped payments, anything out of the ordinary.

- Pay attention to the number of Chase cards you have. While I don’t think there’s a hard limit, one of the reasons given for closing my accounts was that I was “currently over limit on Chase accounts”

- Don’t apply for a bunch of cards every 30-45 days. This flags you as a higher risk and, while you may get away with it for a while, you won’t get away with it forever.

- Don’t stockpile your credit line. Because your score is determined in part by utilization percentage not available credit don’t be afraid to call and lower your credit limits. I never did this so I became a bigger risk to Chase since my available credit was more than double my annual salary.

- Lastly, if you do get shut down. Don’t think your life is over. We’ve helped several people in the 10xTravel Insider’s Facebook group through the process of appealing a shutdown. Even if you end up in my situation and aren’t able to get the decision reversed, there’s life after Chase.

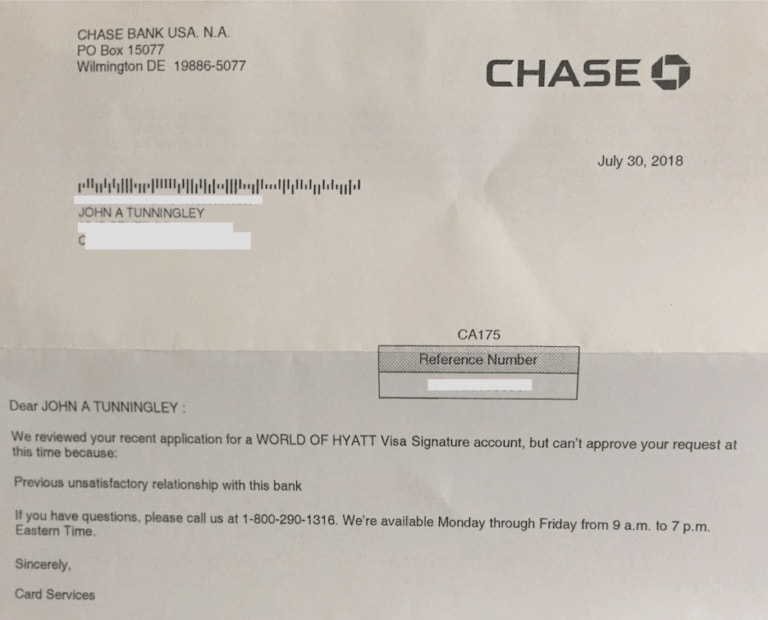

Unfortunately, it seems like it’ll be a little while before I’m able to get another chase card.

Bottom Line

If you create a plan for opening new Chase cards — the 10xTravel Insiders Facebook group is a great place to get some help — you should be able to avoid this nonsense. I know there are plenty of these horror stories out there but there are thousands upon thousands of people in the points and miles community.

Making smart decisions can generally prevent this kind of issue, but if you do find yourself battling Chase to keep your accounts open, reach out to us. We’re happy to help.

New to the world of points and miles? The Chase Sapphire Preferred® Card is the best card to start with.

With a bonus of 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening. , 5x points on travel booked through Chase Travel℠ and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

Editors Note: Opinions expressed here are author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.