10xTravel is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or may no longer be available. The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. You can view current offers here.

All information about Hilton Honors Aspire Card from American Express has been collected independently by the 10x Travel. The card details on this page have not been reviewed or provided by the card issuer.

Editors Note: Two Card Trips is a series of articles that show how you could book a trip using points/miles earned from just two different credit cards. Today’s two card trip takes us to Berlin with points earned from the United Business Card and Hilton Honors Aspire Card from American Express.

Berlin, Germany is a city that has something for everyone. There’s art, history, performing arts, cool shopping and an amazing food and cafe scene. It’s especially fascinating for anyone who’s interested in 20th-century history. The city has been through quite a transformation and is now redefining itself as a major cultural destination.

Let’s look at how you can book an amazing trip to Berlin with just two cards: the United℠ Business Card by Chase and the Hilton Honors American Express Aspire Card.

The Card To Get You There

If you fly United a couple of times a year, then the United℠ Business Card is a great card to keep in your wallet long term.

One of the benefits that I value the most is the ability to check one bag for free for the primary cardholder and one companion. United charges $30 per bag one way, so even if you are flying solo, you can save $60 on one trip! To take advantage of this benefit, you need to pay the taxes and fees on the award ticket with the Explorer card.

Earn 75,000

Bonus Miles

and 2,000 PQP after you spend $5,000 on purchases in the first 3 months your account is open.

Annual Fee: $0 for your first year, then $150.

The card also comes with priority boarding. You’ll be among the first people on the plane and will be able to snag some coveted space in the overhead bin for your carry on bag. You will also receive two United Club passes annually – another great benefit of this card. United Clubs are a great place to get away from the airport crowds and get a free drink and some snacks.

There are no foreign transaction fees. I fly United often, so I am definitely keeping the card long-term for the free checked bags and priority boarding features!

You will earn 2X on United purchases, at restaurants, gas stations and office supply stores and 1X on everything else. Your miles won’t expire due to inactivity as long as you have the card.

You have to be under 5/24 to get approved for the Explorer Business card. However, because it’s a business card, once you are approved, it won’t affect your 5/24 status.

How to Book United Award Flights

After you meet the minimum spending requirement, you should have at least 53,000 United MileagePlus miles and probably more if you had any bonus category spend.

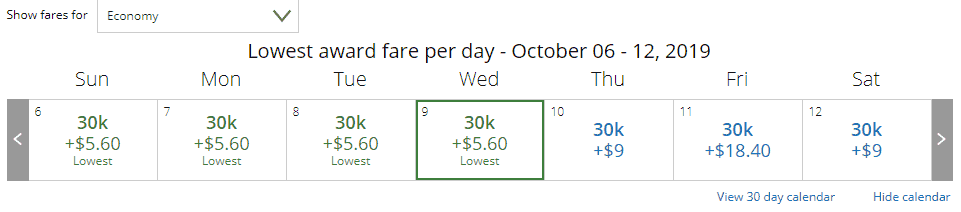

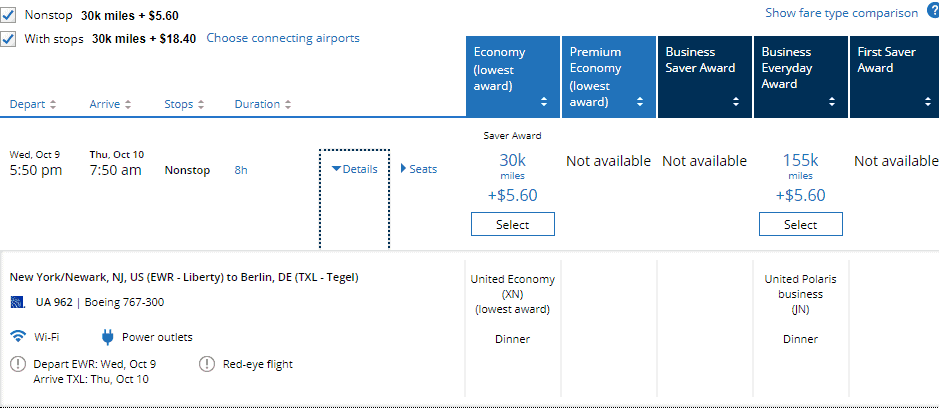

United has region-based award chart, so no matter where you are located in the U.S., the saver level award flights to Europe are going to be 30,000 United miles one way.

United is moving to dynamic award pricing as of November 15, 2019. However, this will only affect flights on United at this time. For now, partner award rates will still be set based on region.

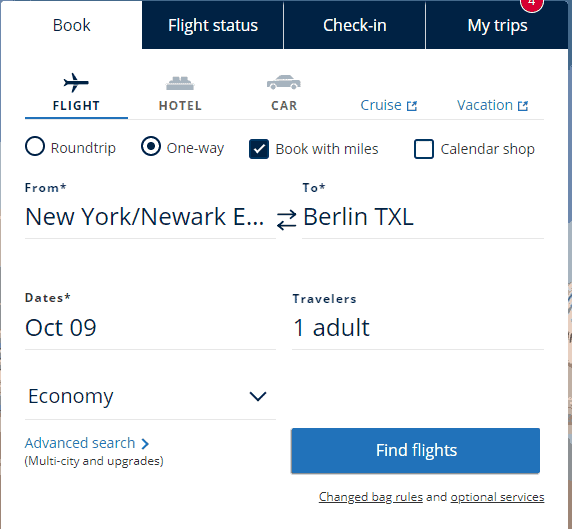

To start your award search, log into your United account because United shows more award space to its own elites and United credit card holders. Make sure you check the box next to Book with miles. And if you have a very flexible schedule, check Calendar shop to see the entire month.

You’ll see the whole week’s worth of availability on the next screen and you can expand to 30-day calendar from there too.

Here are the results of our search for one way flight to Berlin.

As you can see, the taxes are minimal.

Pro tip: You don’t have to book a round trip flight with United miles, so I would recommend booking two one way awards instead. You will have more flexibility if you need to make any changes in the future.

How to Pay for Your Stay in Berlin

The Hilton Honors American Express Aspire Card is a great card and can help earn free nights at some really nice Berlin hotels.

This card often has a welcome bonus of 150,000 Hilton Honors points after you spend $4,000 in the first three months. Its annual fee is $450, which is not waived the first year. However, don’t dismiss this card outright because of its high annual fee because the card offers great value and has lots of valuable benefits that will help offset the annual fee.

One of its greatest benefits is an annual free weekend night certificate. Unlike other credit cards, you don’t have to wait until your first year cardmember anniversary. You should have the free night very soon after you open the account.

The card also comes with complimentary Diamond status that gets you free breakfast at all Hilton brands and access to the Executive Lounge (if one is available). Another great benefit of Diamond status is access to suite upgrades.

Executive Lounge at Hilton Berlin | Photo Courtesy of Hilton Hotels

Other benefits include:

- $250 Hilton Resort Statement Credit at participating Hilton Resorts

- Priority Pass Select membership

- No Foreign Transaction Fees

- $250 Airline Fee Credit

- Car Rental Loss and Damage Insurance

The card earns 14X at Hilton properties; 7X on flights booked directly with airlines and car rentals booked directly with car rental agencies; 3X on everything else.

As you can see, this is a great card that offers some really valuable benefits. You can get this card if you are over Chase’s 5/24 and are looking for good cards from other banks.

Optimizing Card Benefits for Berlin Trip

To use the $250 airline fee credit, you first need to declare your preferred airline with American Express. It’s very easy to do so on the website, under Benefits tab, or via an online chat with an Amex rep. The airline fee credit can’t be used to purchase tickets, but it can be used for upgrades. So why not upgrade your seat to Economy Plus and be more comfortable on the long transatlantic flight?

If you don’t have a Priority Pass membership from another premium card, enroll in Priority Pass and make sure to visit airport lounges and restaurants participating in the Priority Pass network.

If you don’t yet have Global Entry, definitely apply for it as soon as you get the card. Make sure to pay the Global Entry fee with your Hilton Aspire card and you will be reimbursed within one or two billing cycles. Global Entry includes TSA PreCheck, which is also a great benefit when you are trying to get through airport security quickly.

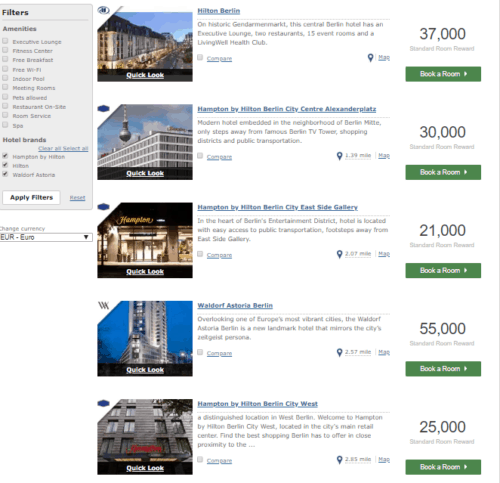

Finding the Right Hilton Hotel

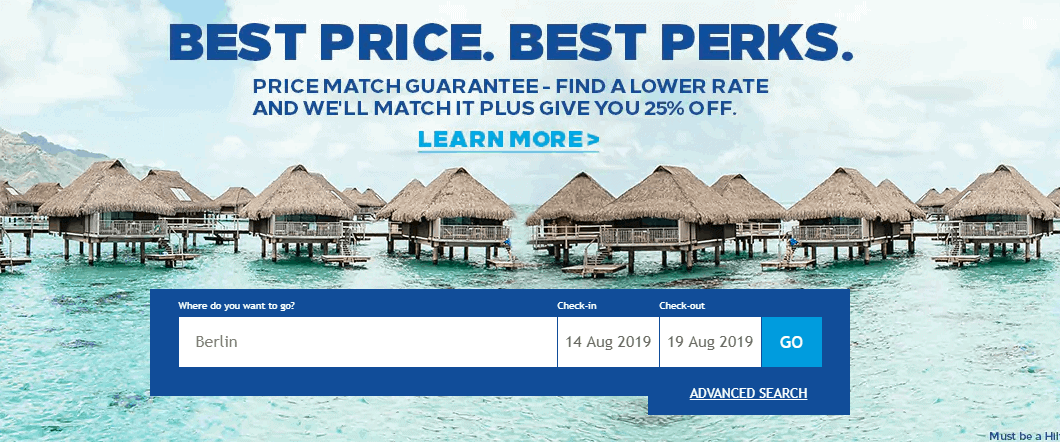

To search for Hilton hotels in Berlin, enter the city and your travel dates on Hilton’s site.

Unfortunately, Hilton doesn’t have an award chart. The price in points changes based on the demand and the cash rates at the hotel. However, there is a 95,000-point cap on points required — except for the new Walforf Astoria property in the Maldives which goes for 120,000 points. As you can see, there are Hilton properties in Berlin for any points budget. You can stay longer at one of the lower-priced properties or splurge on one of the higher-priced hotels.

One of the greatest benefits of the Hilton Honors program is its “stay four nights, get the fifth-night free” perk. If you add a free weekend night certificate that comes with Hilton Honors American Express Aspire Card, you can stay six nights for the price of four!

Hilton Honors American Express Aspire Card

175,000

Hilton Honors Bonus Points

after you spend $6,000 in purchases on the Card within your first 6 months of Card Membership. Offer ends 8/13/2025.

Annual Fee:

$550

I am planning a trip to Berlin this summer, and I’ve had my eye on Hilton Berlin for some time now because of its location and proximity to some major tourist sites.

Hilton Berlin | Photo Courtesy of Hilton Hotels

The hotel has an Executive Lounge that one can access thanks to the Diamond status that comes with the card.

Bottom Line

So, this is how you can plan a great trip to Berlin on points and miles. Berlin has great public transportation so you definitely don’t need to rent a car. Want to explore Germany beyond Berlin? Germany has an amazing train network and getting around is very easy.

Auf wiedersehen!

New to the world of points and miles? The Chase Sapphire Preferred® Card is the best card to start with.

With a bonus of 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening. , 5x points on travel booked through Chase Travel℠ and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

Editors Note: Opinions expressed here are author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.