10xTravel is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This site may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the 10xTravel team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

Note: Some of the offers mentioned below may have changed or may no longer be available. The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. You can view current offers here.

If you’ve got a hankering for an English pub, afternoon tea or spectacular shopping and dining in historic locations, look no further than London. Whether you’re there for the Changing of the Guard at Buckingham Palace, a stroll through Hyde Park or a play at Shakespeare’s Globe Theater, London has it all.

However, transatlantic flights aren’t the cheapest of things. Knowing how to leverage your everyday spending to earn points toward travel will help you to travel more while paying less out-of-pocket.

In this two-card trip installment, let’s check out how to travel to London and back and pay for your flights and your hotel stay, simply by earning the welcome offers of two credit cards.

The Two Cards to Get You to London and Back: American Express Platinum Card® and Marriott Bonvoy Boundless® Credit Card

For this trip, we’ve selected American Express Platinum Card® and the Marriott Bonvoy Boundless® Credit Card as the two cards to get us to London and back.

These cards offer luxury perks and typically strong welcome offers, as well as a long list of lucrative transfer partners in the case of the Platinum Card®.

Let’s look at what these two cards have to offer.

American Express Platinum Card®

The Platinum Card from American Express is the juggernaut of premium travel rewards cards.

While its bonus spending categories are less competitive compared to other cards, its combination of statement credit perks and complimentary status benefits make it one of the most powerful cards on the market.

If you’re a frequent traveler who can maximize its perks, you’ll have little problem offsetting its annual fee of $895 (see rates and fees). For instance, the card’s statement credit perks alone add up to at least $1,500 worth of value every year.

Here’s a complete overview of what the Platinum Card® offers in perks and earning rates:

- 5X points on flights purchased directly from airlines or through American Express Travel® on up to $500,000 per calendar year (1X points thereafter)

- 5X points on prepaid hotels booked and paid in advance on AmexTravel.com

- 1X points on all other purchases

- Access to The American Express Global Lounge Collection with more than 1,550 global lounges, including The Centurion® Lounge, Escape Lounges – The Centurion® Studio Partner, Delta Sky Club® when flying Delta, Lufthansa Lounges when flying Lufthansa Group, Plaza Premium, Priority Pass™ Select Lounges and other participating partner lounges

- Complimentary Marriott Bonvoy® Gold Elite Status

- Complimentary Hilton Honors Gold Status

- Exclusive benefits when staying with properties in the Fine Hotels + Resorts® Program

- $100 experience credit when you book a minimum stay of two nights with The Hotel Collection through American Express Travel

- Up to $200 annual statement credit for airline incidental fees, including in-flight purchases and checked bags, to be applied to one qualifying airline

- Statement credit for CLEAR® Plus membership

- Up to $200 annual hotel credit for prepaid Fine Hotels + Resorts® or The Hotel Collection bookings through American Express Travel. The Hotel Collection requires a minimum stay of two nights to qualify for the credit.

- As a Platinum Card® Member, you can get up to $120 in statement credits each calendar year after you purchase an auto-renewing Uber One membership with your Card. Terms apply.

- Up to $300 annual digital entertainment credit, issued in up to $25 monthly credits

- Up to $155 annual statement credit toward Walmart+ membership, given in $12.95 monthly increments, Plus ups not eligible.

- Up to $100 annual statement credit for Saks Fifth Avenue or saks.com, given in up to $50 biannual increments

- Up to $300 annual statement credit for an Equinox+ digital subscription or membership

- Global Entry TSA PreCheck® application fee credit

- Complimentary Avis Preferred®, Hertz Gold Plus Rewards® and National Car Rental® Emerald Club status

- No foreign transaction fees

These cardholder perks make traveling a luxury experience. Perks such as complimentary access to the largest global lounge network, complimentary elite status with Hilton and Marriott, and a statement credit for both Global Entry and CLEAR Plus membership, are guaranteed to make your flights and hotel stays more enjoyable.

As if these benefits weren’t enough, the Platinum Card® Card also comes with a suite of travel insurance perks, ensuring that you’re protected when traveling, both at home and abroad. These include:

- Baggage insurance. If your bag is damaged or lost while traveling with a common carrier, you can be reimbursed up to $3,000 per covered person. For New York state residents, the reimbursement limit is $2,000 per bag per covered person with an aggregate coverage limit of $10,000 for all bags and persons per trip.*

- Car rental loss and damage waiver. If you decline the CDW of the rental car company and charge the entire cost to your card, you’ll be covered in the event of theft and collision damage.*

- Cell phone protection. When you pay your wireless bill using your card, you can be reimbursed up to $800 for the repair or replacement of your cell phone. You can make a maximum of two claims per 12-month period with a $50 deductible per approved claim.*

- Trip cancellation and interruption insurance. If inclement weather, terrorist action or a covered injury or illness interrupts or cancels your trip, you can be reimbursed for non-refundable common carrier fares paid for with your card up to $10,000 per trip and $20,000 per eligible card per 12 months.*

- Trip delay insurance. If your trip is delayed by a covered reason for six hours or more, you can be reimbursed for reasonable expenses paid for with your card up to $500 per trip, with a maximum of two claims per 12-month period.*

With this wide range of cardholder perks, the Platinum Card®’s $895 annual fee doesn’t seem so steep.

American Express Platinum Card®

You may be eligible for as high as 175,000

Membership Rewards® Points

after spending $12,000 in eligible purchases on your new Card in your first 6 months of Membership. Welcome offers vary and you may not be eligible for an offer.

Annual Fee:

$895

Marriott Bonvoy Boundless® Credit Card

The Marriott Bonvoy Boundless® Credit Card—co-issued by Chase—offers solid perks and earning rates for an annual fee of just $95.

As a cardholder, you’ll enjoy the following rates and perks:

- 6X points (17X total points when combined with your Marriott Bonvoy member and elite status point earning rates) on spending at hotels participating in Marriott Bonvoy

- Earn 3X points per $1 on the first $6,000 spent in combined purchases annually on grocery stores, gas stations, and dining.

- 2X points on all other purchases

- Annual free night reward, valid for a one night stay with a redemption value of up to 35,000 points

- One Elite Night Credit toward Elite Status for every $5,000 spent

- Receive 15 Elite Night Credits each calendar year.

- Complimentary Silver Elite Status.

- Receive an upgrade to Gold Elite Status after spending $35,000 within a calendar year.

- Baggage delay insurance

- Lost luggage reimbursement

- Trip delay reimbursement

- No foreign transaction fees

The card gives you the ability to earn points on everyday spending, including 3X points on the first $6,000 spent in combined purchases annually on grocery stores, gas stations and dining. You can also earn 2X points on all other purchases, making it valuable for spending on miscellaneous purchases.

Perks such as an annual free night award, 15 Elite Night Credits every year, complimentary Silver Elite status and the opportunity to get an upgrade to Gold Elite status make this card highly valuable.

Marriott Bonvoy Boundless® Credit Card

Earn 5 Free Nights

(each night valued up to 50,000 points)

after spending $3,000 on eligible purchases within 3 months of account opening with your Marriott Bonvoy Boundless® Credit Card. Certain hotels have resort fees.

Annual Fee: $95

How to Earn Each Cards’ Welcome Offers

Welcome offers are one of the most valuable aspects of travel rewards credit cards. At no other point will you receive such a high rate of points per dollar spent compared to when you’re spending toward a welcome offer.

If you earn a welcome offer on the higher side, that works out to an effective points multiplier of between 13X and 16X points per dollar spent—a rate you’d never find on any bonus spending category of any credit card.

In short, it’s essential to earn a card’s welcome offer to maximize the value of your spending.

When trying to earn the welcome offers on the Platinum Card® and Marriott Bonvoy Boundless Credit Card, you’ll likely want to apply for the Marriott Bonvoy Boundless Card first. As the Marriott card is co-issued by Chase, your 5/24 count will be taken into consideration when you apply. Therefore, if you’re already close to filling up all the slots in your 5/24 count, you’re better off applying for the Marriott Bonvoy Boundless Credit Card first.

The Marriott Bonvoy Boundless Credit Card’s welcome offer varies widely, switching between bonus points and free night awards.

The typical free night award-based welcome offer is usually between three and five free night awards (with a redemption value of up to 50,000 points per night) after spending $3,000 to $5,000 within the first three months of card membership. The typical points-based welcome offer is between 75,000 and 125,000 points after spending $3,000 to $5,000 within the first three months of card membership.

If you’re shooting for a minimum spend of $3,000, that means you’ll need to charge at least $1,000 to the card every month. If you’re working toward a minimum spend of $5,000, that works out to $1,667 in spending every month.

If you have an average or lower than average monthly expenditure, it’s typically best to work toward one welcome offer at a time. That enables you to leverage your everyday spending to achieve the minimum spend naturally, rather than through overspending. Therefore, you’d be best off waiting until you’ve hit the Marriott Bonvoy Boundless Card’s minimum spend before applying for the Platinum Card® Card.

Alternatively, if you have a higher than average monthly expenditure, you might be able to work toward earning both welcome offers simultaneously.

To hit a minimum spending threshold of $6,000 or $8,000 within six months, you’d need to charge $1,000 or $1,334 to your card every month, respectively.

That means that if you were to earn the welcome offers for both the Platinum Card® and Marriott Bonvoy Boundless simultaneously, you’d need to spend between $2,000 and $3,001 every month for the first three months, split between both cards, depending on which two welcome offer minimum spends you needed to hit. If this would cause you to overspend, then you’re best off sticking to one welcome offer at a time.

To earn a welcome offer successfully, focus on using your card for as many expenses as possible—whether it’s grocery shopping, online shopping, paying insurance premiums and bills, prepaying vacations or even paying your taxes, just ensure you can pay your balance off in full before your due date, otherwise you’ll run into double-digit interest rates that will erode the value of any points earned.

Flying to London Using Amex’s Transfer Partners

Once you’ve earned the two cards’ welcome offers, you’ll be equipped with a good stash of Membership Rewards points (125,000 to 175,000 points if you were eligible for a targeted offer) and either 100,000 to 125,000 Marriott Bonvoy points or three to five free night awards.

If you pursued a two-player mode strategy—whereby both you and your P2 applied for and earned the welcome offers on each of the cards—you’d have double the number of points at your disposal. That works out to 160,000 to 200,000 Amex points (250,000 to 350,000 Amex points if you both had targeted welcome offers) and either 200,000 or 250,000 Marriott Bonvoy points or six to 10 free night awards.

In other words, you’d have a significant supply of rewards in your arsenal, ready to take you to London and back in style and on the cheap.

To fly to London, you’re going to want to leverage Amex’s transfer partners. While you could use Pay With Points to book your flights through American Express Travel, you’d get only 1 cent per point redeemed. By transferring your points to one of Amex’s many airline partners, you can get a much higher value for your points.

Amex partners with the following airline frequent flyer programs, enabling you to transfer your points at a 1:1 ratio to most partners:

- Aer Lingus AerClub

- Aeromexico Rewards (1:1.6 transfer ratio)

- Air Canada Aeroplan

- Air France-KLM Flying Blue

- All Nippon Airways Mileage Club

- Avianca LifeMiles

- British Airways Executive Club

- Cathay Pacific Asia Miles

- Delta Air Lines SkyMiles

- Emirates Skywards

- Etihad Airways Guest

- Hawaiian Airlines HawaiianMiles

- Iberia Plus

- JetBlue TrueBlue (2.5:2 transfer ratio)

- Qantas Frequent Flyer

- Qatar Airways Privilege Club

- Singapore Airlines KrisFlyer

- Virgin Atlantic Flying Club

When flying to London, you’ll want to focus on transferring your points to Air Canada Aeroplan, Air France-KLM Flying Blue and Virgin Atlantic Flying Club.

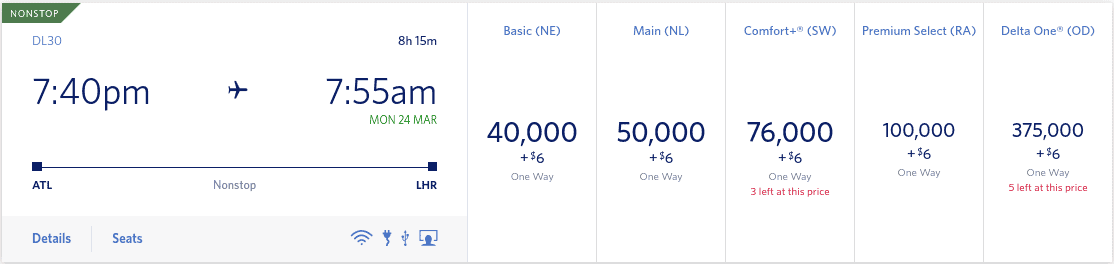

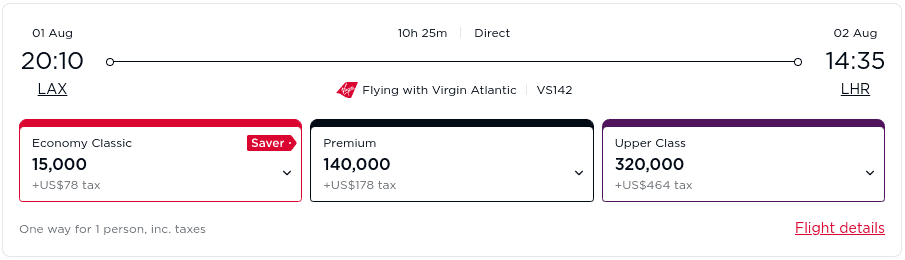

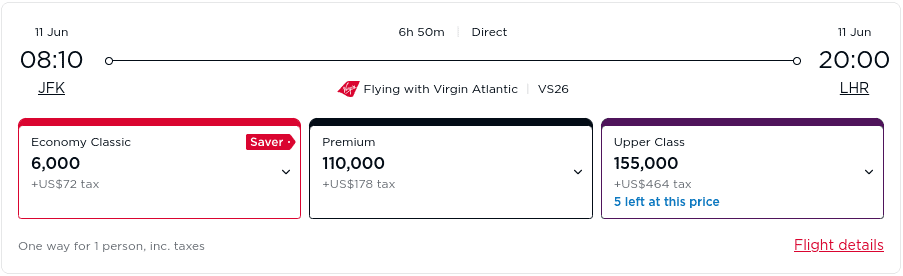

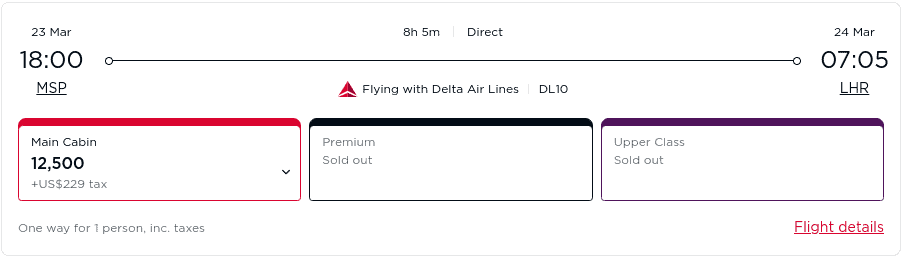

While Delta Air Lines runs many nonstop routes from the U.S. to London, American Express charges an excise tax offset fee of $0.0006 per point transferred to domestic U.S. airlines, up to a maximum of $99 per transfer. Therefore, you’re better off booking Delta award flights through SkyTeam partner Virgin Atlantic to avoid these transfer costs—as well as to avoid Delta’s dynamically-priced award fares.

Let’s now take a look at how to score the best award rates through each of these programs for flights to London.

Air Canada Aeroplan

Air Canada Aeroplan is a solid rewards program when it comes to booking Star Alliance partner award fares.

Aeroplan uses a zone- and distance-based award chart to price its partner award fares. This means you’ll pay more when flying to London from the West Coast compared to the East Coast. However, award rates are still competitive.

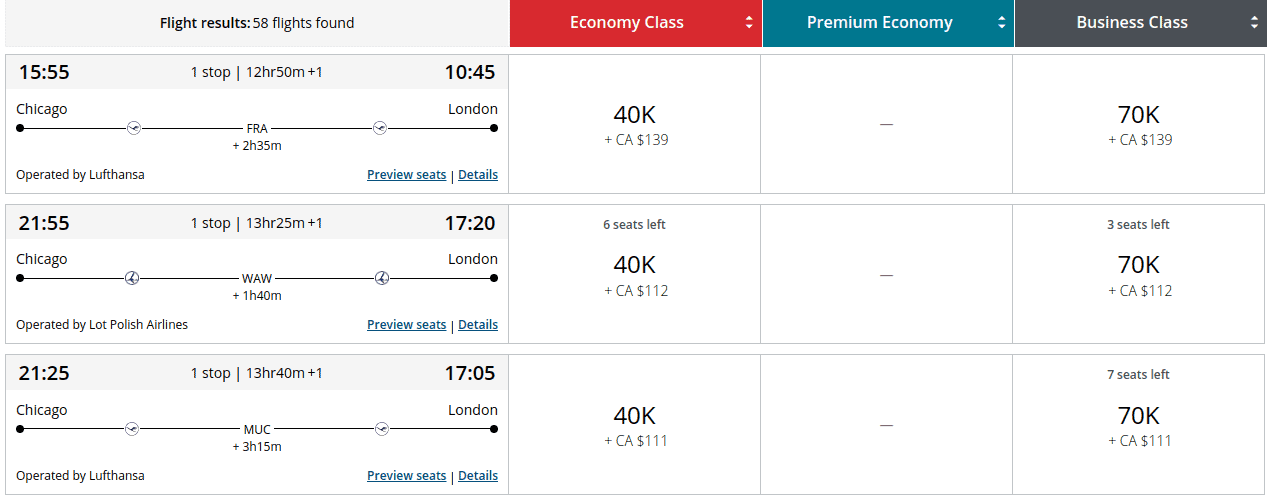

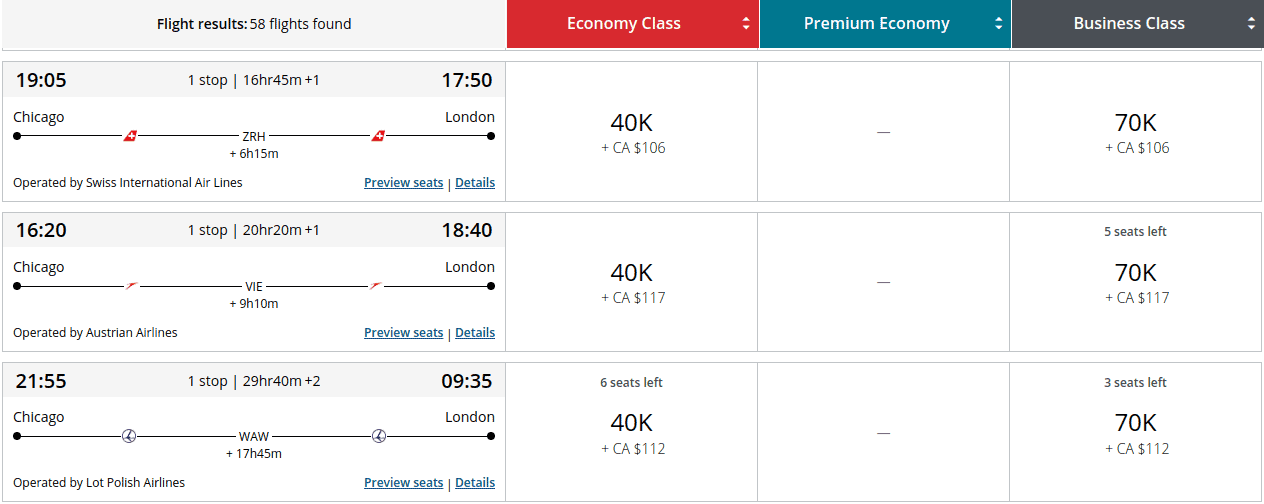

For flights between the U.S. and London (North America and Atlantic Zones), you’ll pay the following rates for partner-award fares booked through Aeroplan:

| Distance (in miles) | Number of points required (per direction) - Economy | Number of points required (per direction) - Business | Number of points required (per direction) - First |

|---|---|---|---|

| 0-4,000 | 35,000 | 60,000 | 90,000 |

| 4,001-6,000 | 40,000 | 70,000 | 100,000 |

A flight from the East Coast or Midwest to London will fall into Aeroplan’s 0-4,000 mile distance category, while a flight from the West Coast or South will fall into the 4,001-6,000 mile category.

These are lucrative award rates, enabling you to fly business-class round-trip to London for just 120,000 points from the East Coast and Midwest or for 140,000 points from the West Coast and South. Round-trip economy fares would cost you 70,000 points or 80,000 points, respectively.

You can find award availability with a range of carriers, from Lufthansa and Swiss International Air Lines, to Austrian Airlines, United Airlines and LOT Polish Airlines.

Aeroplan doesn’t pass on carrier-imposed surcharges, meaning it’s cheaper to book award flights with European airlines such as Lufthansa, Swiss, Brussels Airlines and Austrian Airlines compared to other Star Alliance partners. However, you’ll pay even less in taxes and fees by booking United Airlines-operated award flights through Aeroplan.

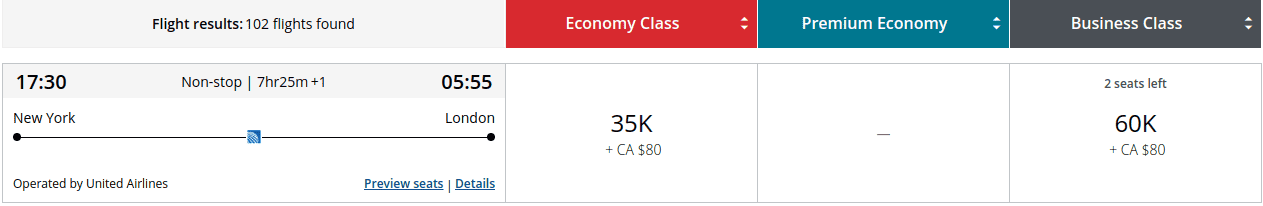

You could fly with United from Newark (EWR) to London (LHR) for just 35,000 points in economy class or 60,000 points in business class, each way, plus $80 Canadian dollars (~$55 USD) in taxes and fees.

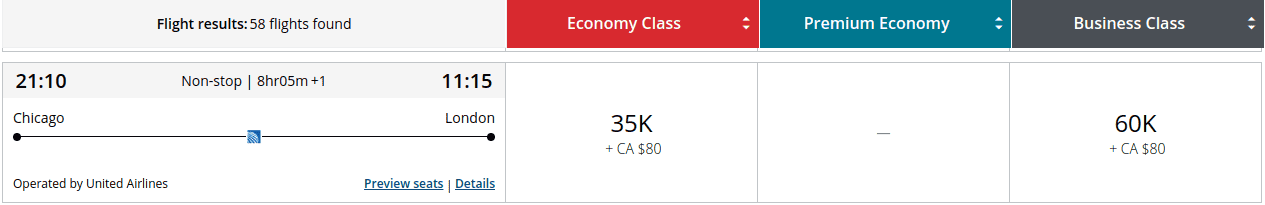

Likewise, you could fly from Chicago (ORD) in economy or business with United to London for the exact same price.

If you flew from the West Coast with United to London, you’d pay 40,000 points in economy and 70,000 points in business, each way.

If you earned a targeted welcome offer on the Platinum Card® Card, you could easily pay for a return business class ticket to London at these rates. And if you were pursuing a two-player mode strategy, both you and your P2 could pay for seats in business class. Otherwise, you’ll need to shoot for economy fares.

Air France-KLM Flying Blue

Air France-KLM Flying Blue can help you score cheap award fares with SkyTeam alliance partners to London and back.

While Air France-KLM prices its award fares dynamically, you can still find low award rates for flights to London.

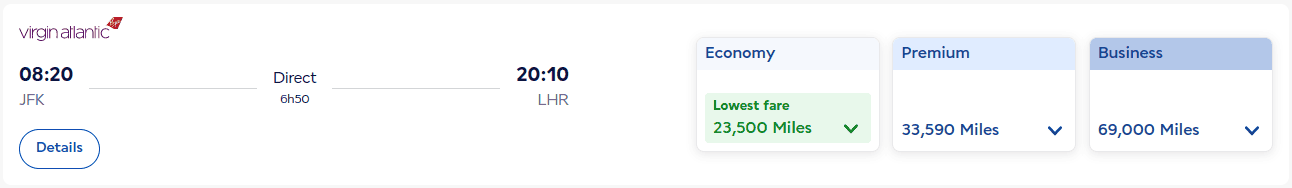

For example, you could fly with Virgin Atlantic to London from New York (JFK) for just 23,500 each way in economy or 69,000 miles in business.

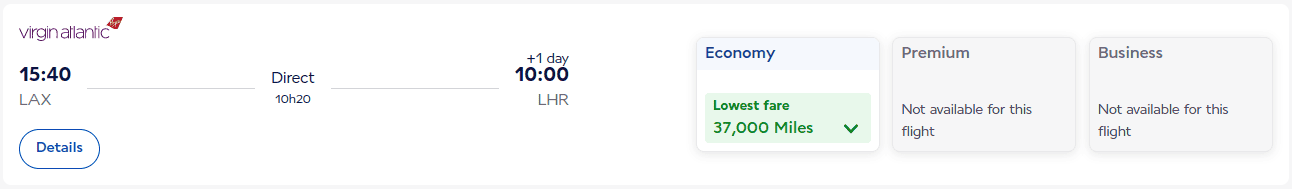

Likewise, you could fly economy from Los Angeles (LAX) to London for just 37,000 miles each way in economy.

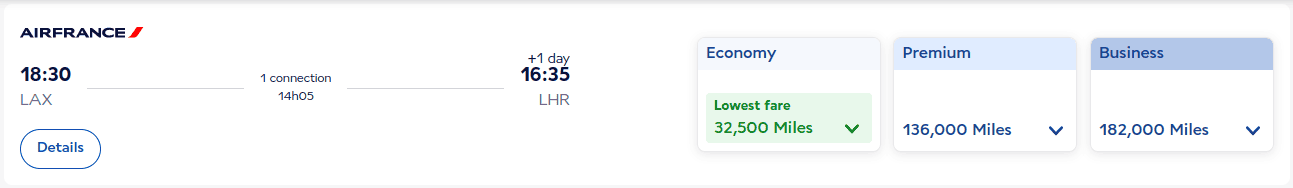

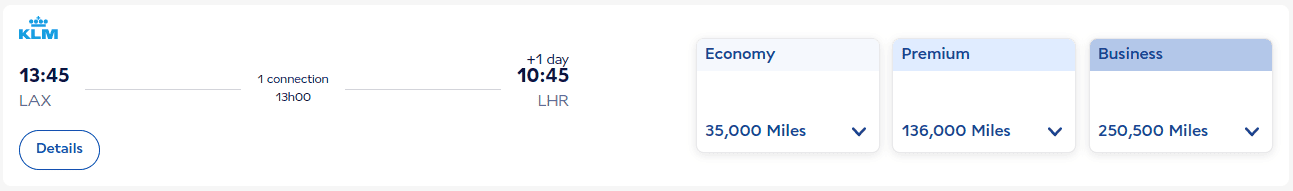

You may also find reasonable award rates for economy fares on Air France- and KLM-operated flights, but you’ll have a connection in Paris or Amsterdam.

Virgin Atlantic Flying Club

Virgin Atlantic Flying Club is another solid American Express transfer partner with whom you can book competitive award fares to London and back.

You can use its partner-award chart to book cheap award fares with Delta Air Lines. By doing this, you can avoid Delta’s dynamically-priced award fares and Amex’s excise tax offset fee.

Here’s an overview of what you can expect to pay when booking Delta flights through Virgin Atlantic.

| Route | Class of service Delta main cabin Off-peak | Class of service Delta main cabin Peak | Class of service Delta One Off-peak | Class of service Delta One Peak |

|---|---|---|---|---|

| East Coast (to UK) | 15,000 | 25,000 | 47,500 | 57,500 |

| Central (to UK) | 17,500 | 27,500 | 47,500 | 57,500 |

| West Coast (to UK) | 20,000 | 30,000 | 67,500 | 77,500 |

While Virgin uses this chart to price most of its Delta award flights, you can sometimes find flights for slightly less (or slightly more).

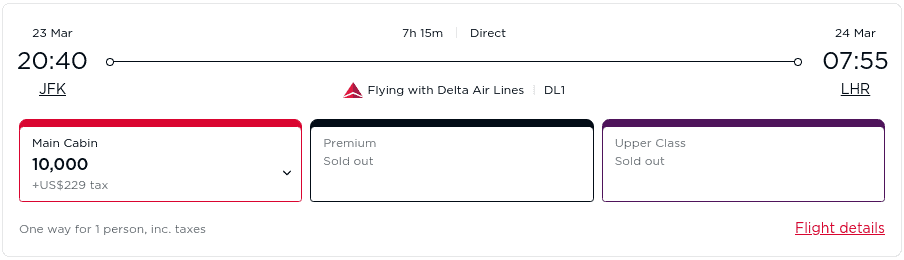

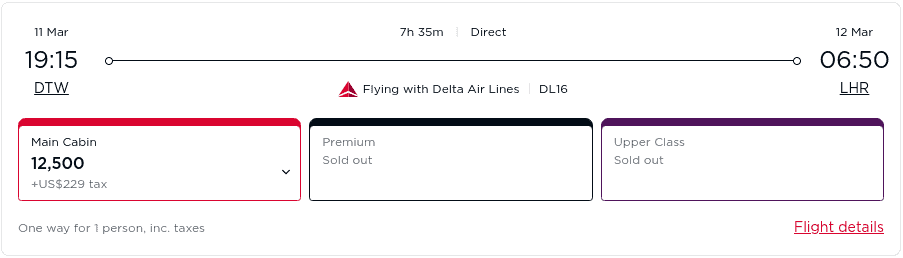

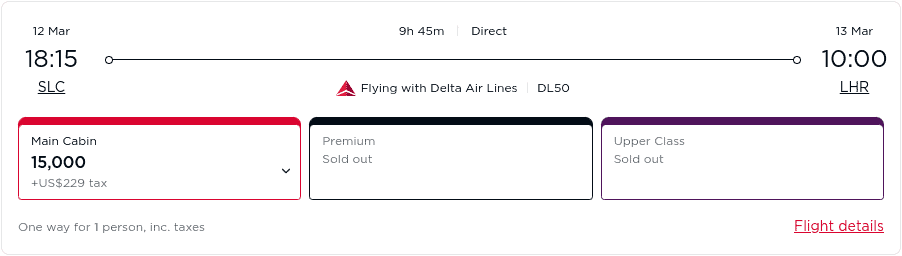

For example, here’s an economy Delta award flight from New York (JFK) to London for just 10,000 points.

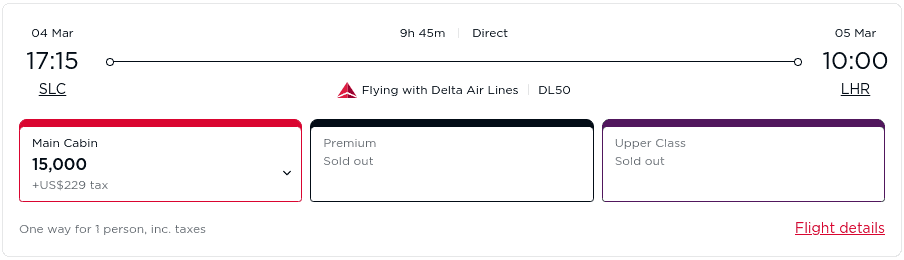

You can save a significant number of points by booking Delta flights through Virgin. For example, a Delta economy award fare from Salt Lake City (SLC) to London would cost you 15,000 points each way booked through Virgin.

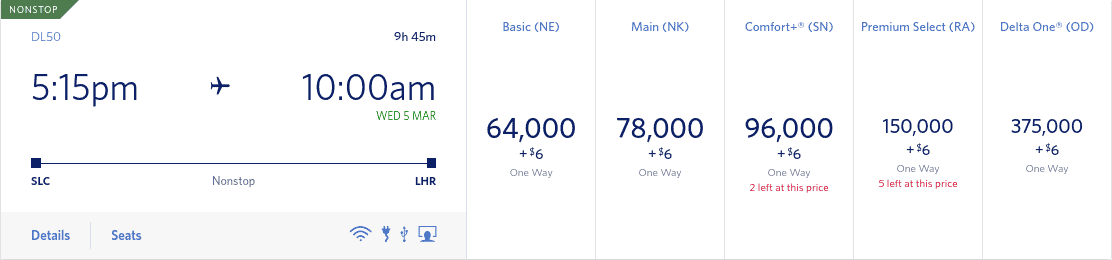

That exact same flight booked directly with Delta would cost you 64,000 miles in basic economy and 78,000 miles in main cabin, each way.

The only benefit to booking directly through Delta is that the taxes and fees are much lower compared to booking via Virgin. However, considering the number of points you’ll save and that you’ll avoid paying Amex’s excise tax offset fee when transferring directly to Delta, you’re often better off booking via Virgin.

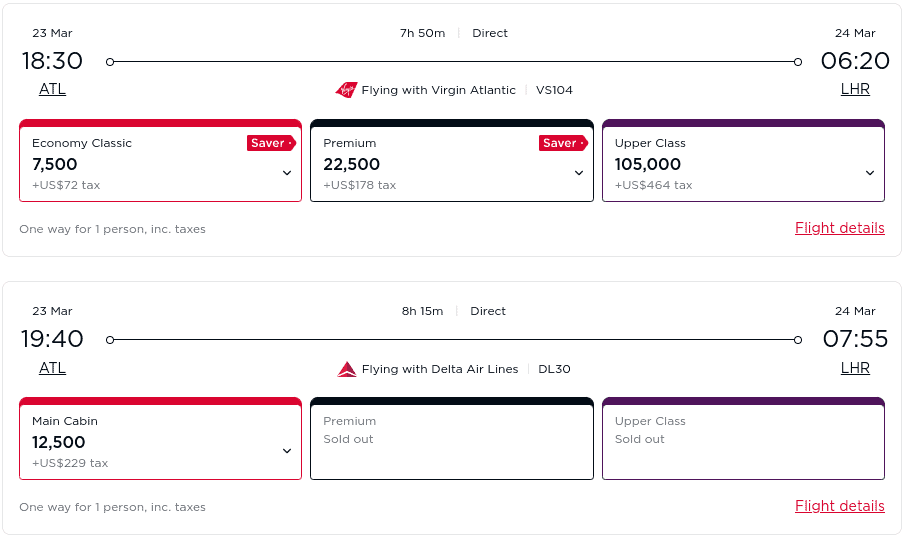

You can also find competitive fares on Virgin-operated award flights to London, in addition to Delta-operated flights. For instance, you could fly from Atlanta (ATL) to London for just 7,500 miles in economy or 22,500 miles in premium economy with Virgin Atlantic, or for 12,500 miles on a Delta-operated flight.

For reference, that same flight booked directly with Delta would cost you 40,000 miles in basic economy or 50,000 miles in main cabin each way.

You can find other competitive saver award fares on Virgin-operated flights, such as 15,000 points each way in economy from Los Angeles (LAX) to London nonstop or just 6,000 points each way in economy from New York to London nonstop.

Delta also operates a number of nonstop flights from across the U.S., making it easier to fly to London without first needing a positioning flight. For example, you could fly from Detroit, Salt Lake City and Minneapolis St. Paul, among other cities, directly to London.

Overall, your Amex welcome offer can take you to London and back on the cheap when booking through Virgin. At such low economy rates, you could fly yourself, your P2 and even your kids to London and back.

Where to Stay in London on Points

With your flights to London booked, the next step is finding a Marriott property for your stay.

You’ll have anywhere between 100,000 and 125,000 points—either in total or per person if pursuing a two-player mode strategy—or three to five free night awards—six to 10 for two-player mode couples—to spend on your hotel accommodation.

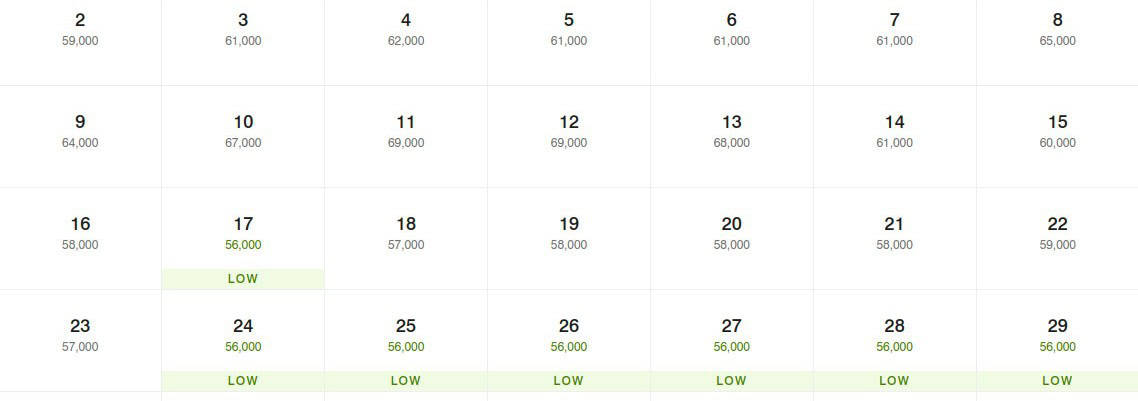

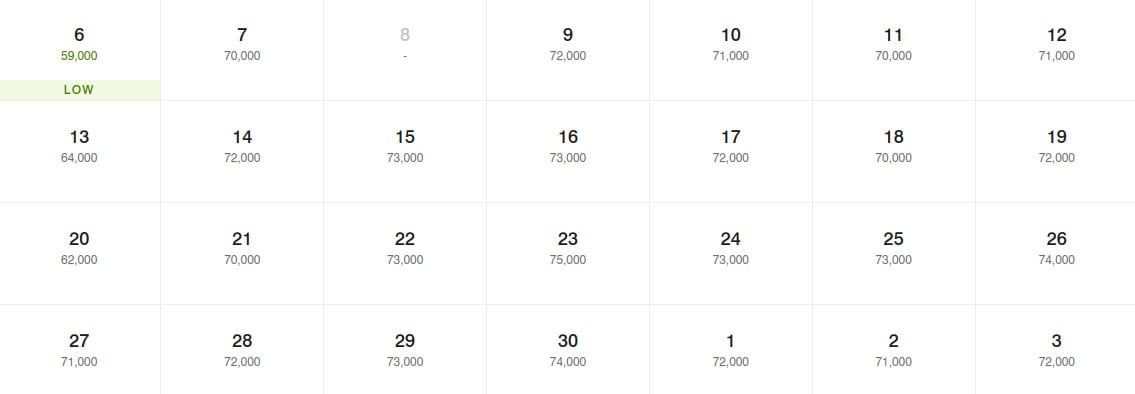

Marriott doesn’t have an award chart, meaning award prices fluctuate based on demand. Therefore, having flexibility with your travel dates is key to scoring the lowest rates.

Let’s take a look at a handful of Marriott properties in London you could stay at. Needless to say, this list isn’t exhaustive and should serve simply as inspiration for the possibilities you have when looking for accommodation in London.

Residence Inn London Bridge

The Residence Inn London Bridge combines practicality with centrality.

You’ll enjoy luxurious suites with kitchenettes, enabling you to self-cater and find your own routine in London life. There’s also a 24-hour on-site gym, a Grab n’ Go market and full daily buffet breakfast.

The Residence Inn isn’t far from some of London’s highlights, including London Bridge, Tower Bridge, The Shard, Borough Market and financial districts such as Canary Wharf. You’re also situated close to Borough Station, enabling you to access the rest of London on the London Underground (the Tube).

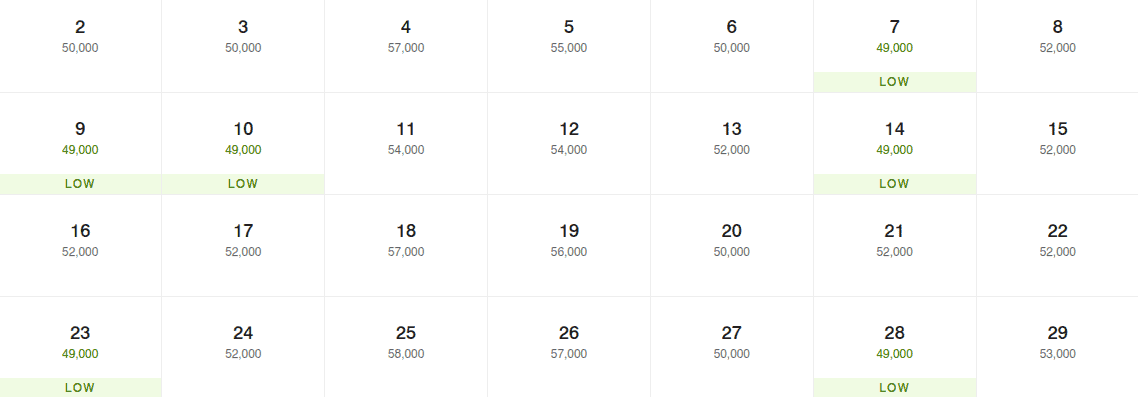

Award prices vary at this property, typically between 49,000 and 58,000 points per night, making it relatively affordable. You could use your free night awards from your welcome offer to pay for a stay here, as long as you redeem them on nights costing 50,000 points or under.

London Marriott Hotel Marble Arch

The London Marriott Hotel Marble Arch offers a luxurious stay for business and vacation trips alike.

Located in Marleybone, this hotel gives you convenient access to hotspots such as Buckingham Palace, Hyde Park, The Regent’s Park, Kensington, London Zoo and Oxford Street.

The rooms themselves have a modern design and include advanced features such as Apple TV technology. You can also take advantage of the hotel’s fitness center as well as its cozy on-site gastropub, The Pickled Hen.

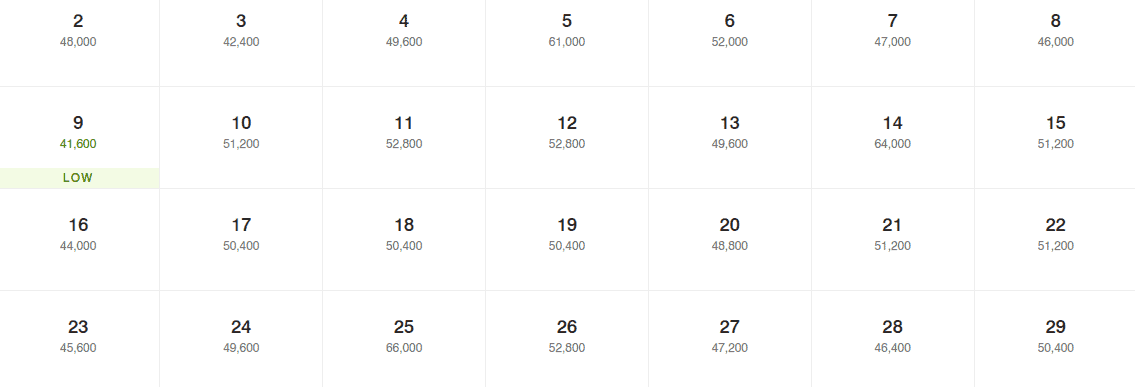

Award rates vary between 41,000 and 66,000 points per night, making this an affordable property where you could potentially redeem your free night awards.

The Park Tower Knightsbridge, A Luxury Collection Hotel, London

The Park Tower Knightsbridge, A Luxury Collection Hotel, London offers style and centrality for a memorable trip.

Between its on-site restaurant (the Trianon), its classic Whiskey bar (The Hyde Bar) and its sophisticated lounge for afternoon tea (The Knightsbridge Lounge), you’ll be spoiled for choice when it comes to dining and drinking.

The Park Tower Knightsbridge is also conveniently located in the heart of London’s hotspots, with Hyde Park, Buckingham Palace, Harrods and Harvey Nichols all on your doorstep.

You can find rooms starting at 56,000 points and reaching 69,000 points, making this a somewhat pricier property. However, you can easily score yourself a few nights here by leveraging your points-based welcome offer—particularly if both you and your P2 earned one.

St. Pancras Renaissance Hotel, London

The St. Pancras Renaissance Hotel, London, is an elegant property that’s stood since 1873. Offering quintessential old-school London charm, this property is steeped in history, giving guests a stay to remember.

When staying at the St. Pancras Renaissance Hotel, you’re not far from landmarks such as King’s Cross Station, Camden Town, Regent’s Canal, Granary Square, the Royal Opera House, the British Museum and Covent Garden.

The hotel also has a partnership with Eurostar, offering a ‘Suite to Seat and Seat to Suite’ service, including a complimentary transfer to and from London St. Pancras International station to guests who are staying in any of its 38 Chambers Suites and using the Eurostar service between 8.00am and 7pm. So if you’re planning to explore the rest of Europe from London, this is an ideal hotel to stay in.

This five-star hotel includes on-site dining, a beautiful bar, spa, indoor pool, fitness center and the exclusive Chambers Club, for those staying in any of its 38 Chamber suites.

Award rates for this property are on the higher end, starting at around 59,000 points and going up to 74,000 points per night. Nevertheless, you could still squeeze a few nights in at this property, especially if you’re earning and traveling in two-player mode.

Final Thoughts

If London’s calling, it doesn’t need to cost you an arm and a leg.

By earning the welcome offers on the Platinum Card® and the Marriott Bonvoy Boundless Credit Card, you’ll be well equipped for a weekend or even a week away in London. And if both you and your P2 earn the welcome offers on each of your respective cards, the possibilities for luxurious hotel stays and round-trip business-class flights are even higher.

If you want to learn how to leverage your everyday spending to travel more for less, sign up to our free 10xTravel course today.

* Eligibility and Benefit level varies by Card. Terms, Conditions, and Limitations Apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by Amex Assurance Company.

New to the world of points and miles? The Chase Sapphire Preferred® Card is the best card to start with.

With a bonus of 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening. , 5x points on travel booked through the Chase TravelSM Portal and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

after spending $12,000 in eligible purchases on your new Card in your first 6 months of Membership. Welcome offers vary and you may not be eligible for an offer.

Annual Fee:

$895

after spending $3,000 on eligible purchases within 3 months of account opening with your Marriott Bonvoy Boundless® Credit Card. Certain hotels have resort fees.

Annual Fee: $95

Editors Note: Opinions expressed here are author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.