10xTravel is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or may no longer be available. The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. You can view current offers here.

If you’re looking forward to booking a new and exciting itinerary, why not consider east Asia? This region of the world hosts a myriad of cultures, traditions, landscapes, and (perhaps most importantly) foods. For US-based travelers wanting to get a taste of China without dealing with a visa process, the easiest thing to do is to check out Hong Kong instead. Although Hong Kong is not explicitly China, visa-free travel for US citizens makes it an easy spot to begin.

Hong Kong is one of those places that can be difficult to nail down — is it its own thing, or what? Officially, Hong Kong is a Special Administrative Region (SAR) of the People’s Republic of China. This means that Hong Kong is not technically part of mainland China but, after being transferred from British rule to China in 1997, it is largely an autonomous area. Hong Kong holds its own government, economy, education system, immigration policy, and trade laws while still technically being attached to China.

Geographically, it’s a metropolis and collection of islands south of Shenzhen and across the estuary from the other current Chinese SAR: Macau. Its relatively small landmass and high population make Hong Kong one of the most densely populated areas in the world, but there are also plenty of parks and natural areas to explore. If you are interested in exploring Hong Kong for yourself, here are a few points properties that we think are great redemption opportunities for your next trip to east Asia.

Marriott

Renaissance Hong Kong Harbor View

For coastal accommodations at Victoria Harbor, redeem your points at Renaissance Hong Kong Harbor View. Located in Wan Chai and attached to the Hong Kong Convention and Exhibition Centre, this property is ideal for those traveling to Hong Kong on business or wishing to host a spectacular event.

Rennaisance Hong Kong Harbor View (Image Courtesy from Marriott)

Of course, this is also ideal for guests who wish to enjoy stunning harbor views, walks along coastal promenades, or explore one of the numerous urban green spaces on Hong Kong Island. These include Hong Kong Park, Victoria Peak Garden, and Aberdeen Country Park. After your outdoor adventure, return to the hotel to grab a bite at the onsite Dynasty restaurant and take in the stunning skyline from your cozy room.

A night at this Category 6 hotel is available from 40,000 Marriott Rewards points.

The Mira Hong Kong, Design Hotels

If you’re looking for a hotel that is just as much of a destination as Hong Kong itself, book in with The Mira Hong Kong, a member of Design Hotels. This trendy concept is located in the buzzing Tsimshatsui neighborhood, just across the street from Kowloon Park.

The Mira Hong Kong, Design Hotels (Image Courtesy from Marriott)

With six onsite restaurants and an award-winning spa, it might be tempting to stay onsite for the duration of your stay, but you shouldn’t miss an excursion to the nearby shopping, dining, and entertainment options.

Design elements at this property feature sharp angles, eye-pleasing curves, and well-placed pops of color within expertly crafted open-concept spaces. Truly a place for the modern traveler, this is a great hotel to redeem your points.

A night at this Category 5 hotel is available from 30,000 Marriott Rewards points.

Cards to Help You Earn Marriott Points

Marriott Bonvoy Boundless® Credit Card

One of the quickest ways to earn Marriott points is to open a line of credit with the Marriott Bonvoy Boundless® Credit Card from Chase. Not only do cardholders have the opportunity to earn more Bonus Points on everyday spending, but they also earn automatic Silver Elite status simply by being cardholders. Cardholders earn 6X points per $1USD spent on purchases at Marriott Properties and 2X points per $1USD spent on all other purchases.

With all of these benefits, this card is well worth the $95 annual fee; however, there is another way to skip the annual fee.

Marriott Bonvoy Boundless® Credit Card

Earn 5 Free Night Awards

(each night valued up to 50,000 points) after spending $5,000 on eligible purchases within 3 months of account opening. Certain hotels have resort fees.

Annual Fee: $95

Marriott Bonvoy Bold® Credit Card

If you want extra benefits without the annual fee, apply for the Marriott Bonvoy Bold® Credit Card from Chase. You’ll still have access to complimentary Silver Elite Status and earn 3X points per $1USD spent on purchases at Marriott properties. You’ll also earn 2X points per $1USD spent on travel purchases and 1X points per $1USD on all other purchases.

If you want a quick path to Silver Elite and a decent earning potential without committing to an annual fee, the Marriott Bonvoy Bold could be the right pick for you.

Marriott Bonvoy Bold® Credit Card

Earn 60,000

Bonus Points plus 1 Free Night Award

after spending $2,000 on purchases in the first 3 months from account opening. Free Night Award valued up to 50,000 points. Certain hotels have resort fees.

Hilton

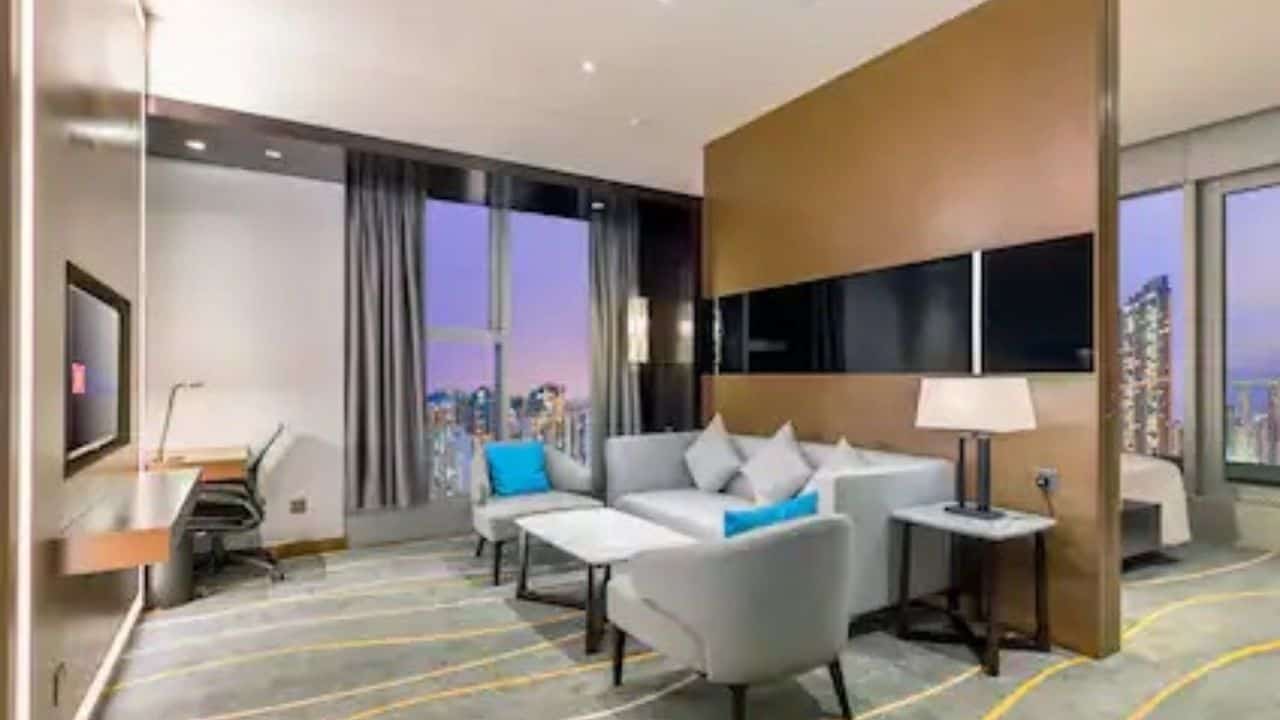

Hilton Garden Inn Hong Kong Mongkok

For easy-on-the-points accommodation in an exciting entertainment district, book in with the Hilton Garden Inn Hong Kong Mongkok.

Located in an area of Kowloon that is well known for its amazing shopping, dining, and nightlife opportunities, this property is ideal for visitors who are ready to hit the town during their stay. Explore the surrounding boutiques and bars, then treat yourself to a glittering skyline view from the hotel’s beautiful rooftop pool.

Hilton Garden Inn Hong Kong Mongkok (Image Courtesy from Hilton)

Enjoy easy access to Cherry Street Park for a pleasant stroll, or catch the metro to connect with other areas of Hong Kong. Then, return to your comfortable bed at the end of your day (or night) on the town.

A night at this property is available from just 14,000 Hilton Honors points.

Cards to Help You Earn Hilton Points

Hilton has a long-standing partnership with American Express and offers four different co-branded cards: three personal cards and one business card. Here, we’ll mention the perks of our favorite personal card as well as the business card.

The Hilton Honors American Express Business Card

Perfect for business owners on the go, The Hilton Honors American Express Business Card (Rates & Fees) is a card with decent earning potential and plenty of travel benefits. While it comes with a $195 annual fee, cardholders earn 12X Bonus Points per $1USD spent on Hilton purchases and 5X on other purchases on the first $100,000 in purchases each calendar year, 3X points thereafter.

In addition, this card is an excellent way to jump straight to Gold Status; a $195 annual fee is a pretty small price to pay considering that benefit. Plus, you’ll have the opportunity to upgrade to Diamond Status depending on how much you’re planning on using the card, which is a definite bonus.

The Hilton Honors American Express Business Card

Limited time offer: Earn 150,000

Hilton Honors Bonus Points

after you spend $8,000 in purchases on the Hilton Honors Business Card within the first six months of Card Membership. Plus earn an additional 25,000 Hilton Honors Bonus points after you spend an additional $2,000 in purchases on your card within your first 6 months of card membership. Offer Ends 8/13/2025.

Annual Fee:

$195

Hilton Honors Aspire

The Hilton Honors American Express Aspire Card is our favorite credit card in the collection, and it comes with a hefty $450 annual fee.

At first glance, it might not seem worth it to splurge on a high-fee card when the Bonus Points earning potential is only marginally better than the other three cards in the collection. However, when weighing the annual fee against the additional benefits, it might be a good deal if you’re looking to skyrocket your status.

Cardholders earn 14X Bonus Points per $1USD spent on Hilton purchases, 7X Bonus Points per $1USD spent on purchases at US restaurants, flights booked directly with the airline or through American Express Travel®, and cars booked directly through select car rental agencies, and 3X Bonus Points per $1USD spent on all other eligible purchases.

Note that the value of the accompanying travel benefits surpasses the annual fee, so as long as you’re planning on using the benefits, this card is well worth it.

Hilton Honors American Express Aspire Card

175,000

Hilton Honors Bonus Points

after you spend $6,000 in purchases on the Card within your first 6 months of Card Membership. Offer ends 8/13/2025.

Annual Fee:

$550

IHG

InterContinental Grand Stanford Hong Kong

For luxury on the water, the InterContinental Grand Stanford Hong Kong is pretty hard to beat.

Located on the south end of Kowloon, this gorgeous property features stunning views of the nearby Hong Kong Island and the harbor in between. Enjoy a dip in the stunning outdoor pool or a meal at one of the several dining concepts on site.

InterContinental Grand Stanford Hong Kong (Image Courtesy from IHG)

Don’t miss a stroll down the Avenue of Stars to the Hong Kong Museum of Art and the Hong Kong Space Museum, then further to the Hong Kong Cultural Centre Promenade. Hop on a ferry to Hong Kong Island or one of the many other nearby islands and enjoy a perfect mix of city and nature, then sail back to your cozy bed when you’re ready to come back.

A night at this hotel is available from 30,000 IHG Rewards points.

Cards to Help You Earn IHG Points

IHG One Rewards Premier Credit Card

The IHG One Rewards Premier Credit Card from Chase is the premium card in the IHG collection.

This card comes with an $99 annual fee, but it includes automatic Platinum Elite Member status and up to 26X points per $1 spent at IHG properties, which include existing reward benefits from your status.

IHG One Rewards Premier Credit Card

Earn 5

Free Nights.

after spending $5,000 on purchases in the first 3 months from account opening.

Annual Fee: $99

IHG One Rewards Traveler Credit Card

Of course, the Premier level card doesn’t suit everyone. If you are an IHG Rewards member interested in opening an IHG line of credit but don’t want to bother with any annual fees, then signing up for the IHG One Rewards Traveler Credit Card from Chase could be a better move.

This card does come with the opportunity to bump up to Gold Elite, which is a nice perk for members with Club Member status. Additionally, you can earn up to 17X points per $1 spent at IHG properties worldwide when combined with your status.

IHG One Rewards Traveler Credit Card

Earn 120,000

Bonus Points

after spending $2,000 on purchases within the first 3 months of account opening.

Hyatt

Lanson Place Causeway Bay, Hong Kong

It’s difficult to feel alone in a city like Hong Kong, but if you’re looking for a little “me time,” you might consider checking into a boutique hotel like Lanson Place Causeway Bay.

Lanson Place Causeway Bay, Hong Kong (Image Courtesy from Hyatt)

This property features more of an apartment-style vibe than that of a hotel, where each room feels a bit like an open-concept studio apartment. Located near Victoria Park, visitors have plenty of opportunities to explore the island’s urban green spaces as well as the upscale shopping districts nearby.

Don’t forget to spend some time enjoying the property itself, perhaps relaxing with a book at the onsite Bar & Library. A pleasing mix of the old and the new, this property is ideal for travelers looking for a peaceful, leisurely getaway.

A night at this member-only property is available from 15,000 World of Hyatt points.

Cards to Help You Earn World of Hyatt Points

If you’re looking to maximize your earning potential with World of Hyatt, the best way to do that is by – you guessed it – opening up a line of credit. Currently, the The World of Hyatt Credit Card is offering a sign-up bonus that can help you plan your stay.

Cardholders earn 9X Total Points per $1USD spent at Hyatt properties, 2X Bonus Points on transportation, restaurants, flights purchased directly through the airline, and fitness club memberships, and 1X Bonus Points per $1USD spent on all other purchases.

The World of Hyatt Credit Card

Earn up to 60,000

Bonus Points

Earn 30,000 Bonus Points after you spend $3,000 on purchases in your first 3 months from account opening. Plus, up to 30,000 more Bonus Points by earning 2 Bonus Points total per $1 spent in the first 6 months from account opening on purchases that normally earn 1 Bonus Point, on up to $15,000 spent.

Annual Fee: $95

Chase Travel Portal

The above properties are wonderful options for Hong Kong, but they aren’t so exciting if you haven’t stocked up on a bunch of points in exactly the right currency. If you don’t have a stash of brand-specific points lying around, there is another option.

Many credit cards offer their own rewards programs that include the opportunity to redeem points on travel. If you’ve been stockpiling credit card rewards instead of brand-specific hotel rewards, a trip to Hong Kong could be a great way to redeem them.

For example, you could use your stash of Chase Ultimate Rewards Points to book your hotel. With the Chase Sapphire Reserve®, you can get exceptional value through Chase Travel℠. Chase now offers Points Boost, which gives you the ability to redeem points for up to 2x their value on select flights and hotels. That bonus is a great incentive to use them on a trip to Hong Kong! Here is one of the properties in Hong Kong that you can book through the Chase Ultimate Rewards portal.

Auberge Discovery Bay Hong Kong

If you’d really like to stay off the beaten path in Hong Kong, there are plenty of properties available on the islands surrounding Kowloon and Hong Kong Island. One such property is Auberge Discovery Bay Hong Kong, a lovely resort on Lantau Island. This hotel is located on Discovery Bay which is bound by beaches and surrounded by lush, green mountains.

For visitors wishing to visit Hong Kong Disneyland, this hotel is an ideal stay; but keep in mind that there are several other attractions on the island including hiking trails, cable cars, golf and adventure parks. Whether you’re planning an unforgettable family vacation or a destination wedding, this resort is well worth the points redemption.

A night at this property is available from 12,300 Ultimate Rewards points.

Auberge Discovery Bay Hong Kong (Image Courtesy of Auberge Discovery Bay)

Cards to Help You Earn Ultimate Rewards Points

Chase Sapphire Reserve®

A consistent favorite of the Chase collection is the Chase Sapphire Reserve®, offering unparalleled opportunities to earn Ultimate Rewards points and benefit from travel perks. Its hefty $795 annual fee is offset by an annual $300 travel credit, plus built-in insurance and protections for when you’re on the go.

Earn 100,000

bonus points + $500 Chase Travel℠ promo credit

after you spend $5,000 on purchases in the first 3 months from account opening.

Annual Fee: $795

Chase Sapphire Preferred® Card

If a $795 annual fee just doesn’t sound like a good time, apply for the Chase Sapphire Preferred® Cardinstead. With a $95 annual fee and an impressive bonus offer, this card is ideal for any applicant. You’ll still enjoy some travel benefits as well as the ability to earn bonus points on dining, streaming services and online grocery orders (excluding Target and Walmart), which can be redeemed through the Travel Portal.

Chase Sapphire Preferred® Card

75,000

bonus points

after you spend $5,000 on purchases in the first 3 months from account opening.

Annual Fee: $95

Final Thoughts

Hong Kong SAR is an ideal destination for travelers who enjoy saturating their senses, whether it’s soaking up the intensity of city life or the immersive hikes through the surrounding islands and mountains. This is especially simple for US-based travelers who don’t want to deal with Chinese visa applications because Hong Kong is visa-free for US citizens. If you’re looking for a great spot to redeem your stockpile of points, Hong Kong is an excellent choice!

New to the world of points and miles? The Chase Sapphire Preferred® Card is the best card to start with.

With a bonus of 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening. , 5x points on travel booked through Chase Travel℠ and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

Editors Note: Opinions expressed here are author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.