10xTravel is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This site may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the 10xTravel team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

Note: Some of the offers mentioned below may have changed or may no longer be available. The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. You can view current offers here.

In early 2023, Delta Air Lines introduced a benefit to many of its co-branded credit cards known as TakeOff 15. This feature offers a 15% discount on Delta- and Delta Connection-operated award flights booked with Delta SkyMiles. If you have one of the qualifying Delta co-branded credit cards, then you have a much stronger incentive to redeem the SkyMiles earned with that card (or cards) on Delta-operated flights. Additionally, if you tend to take award flights with Delta, this discount could amount to hundreds of miles in savings per year.

It’s worth noting, though, that partner award flights aren’t eligible for the TakeOff 15 discount. However, you may be able to use the TakeOff 15 feature to save on flights you’ve already booked even if you don’t currently have a Delta co-branded credit card in your wallet.

In this article, we’ll be discussing everything you need to know about Delta’s TakeOff 15 benefit, including which cards include this benefit, when getting one of these cards might make sense for you, how to use this benefit, how to apply this benefit to flights you’ve already booked and whether there are better ways to book Delta flights than through the SkyMiles program (regardless of whether or not you have the TakeOff 15 benefit).

Which Cards Are Eligible for the Delta TakeOff 15 Benefit?

All Delta SkyMiles co-branded credit cards in the U.S. are issued by American Express and the majority of these Amex-Delta cards include the TakeOff 15 perk. Here are all of the cards with which you can get this benefit:

- Delta SkyMiles® Gold American Express Card (rates & fees)

- Delta SkyMiles® Gold Business American Express Card (rates & fees)

- Delta SkyMiles® Platinum American Express Card (rates & fees)

- Delta SkyMiles® Platinum Business American Express Card (rates & fees)

- Delta SkyMiles® Reserve American Express Card (rates & fees)

- Delta SkyMiles® Reserve Business American Express Card (rates & fees)

The only U.S. Delta SkyMiles credit card that isn’t eligible for the TakeOff 15 benefit is the Delta SkyMiles® Blue American Express Card (rates & fees), Delta’s no-annual-fee beginner card.

It’s also worth mentioning that Delta also offers several co-branded credit cards in Japan from several different issuers, including American Express, Diners, JCB and Visa. None of these credit cards are eligible for the TakeOff 15 discount.

How to Use the TakeOff 15 Discount

Once you sign up for one of the eligible cards listed above, you’ll instantly become eligible for the TakeOff 15 discount when booking Delta award flights with SkyMiles. It’s worth noting that this discount can be applied to award redemptions made with any Delta miles, not only Delta miles earned with your credit card.

For example, if you have a balance of 50,000 SkyMiles in your account, all of which were earned by taking flights with Delta and other SkyTeam Alliance airlines, those miles are also eligible for the TakeOff 15 discount if you have one of the eligible Delta co-branded credit cards and you use them to purchase Delta- or Delta Connection-operated award flights.

Let’s take a look at how you can apply this discount to future bookings and past bookings.

How to Apply TakeOff 15 to New Bookings

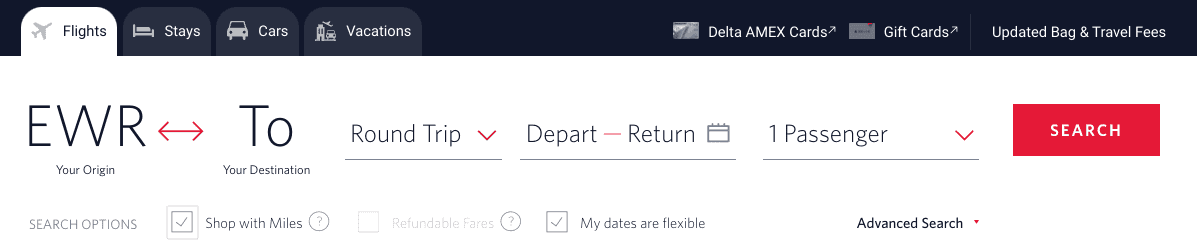

To get your TakeOff 15 discount when making new bookings, you can go through the award booking process as you normally would. Simply sign into your SkyMiles account and search for flights that match your desired dates, origin and destination, cabin class and number of passengers. Then, you need to check the “Shop with Miles” box.

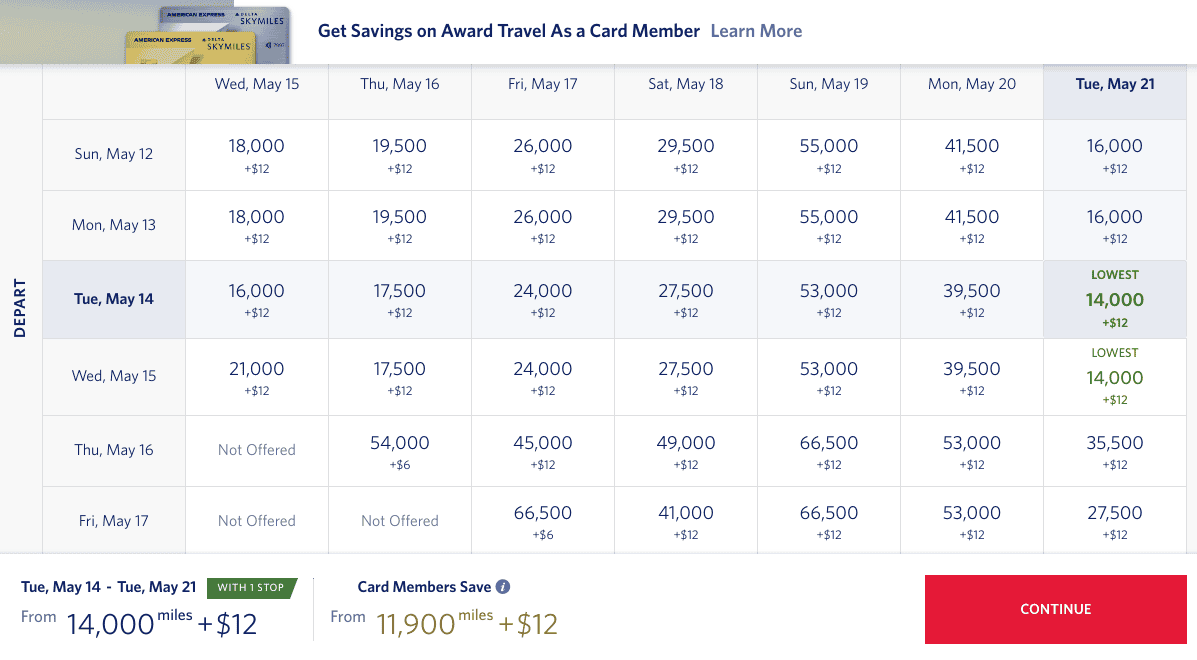

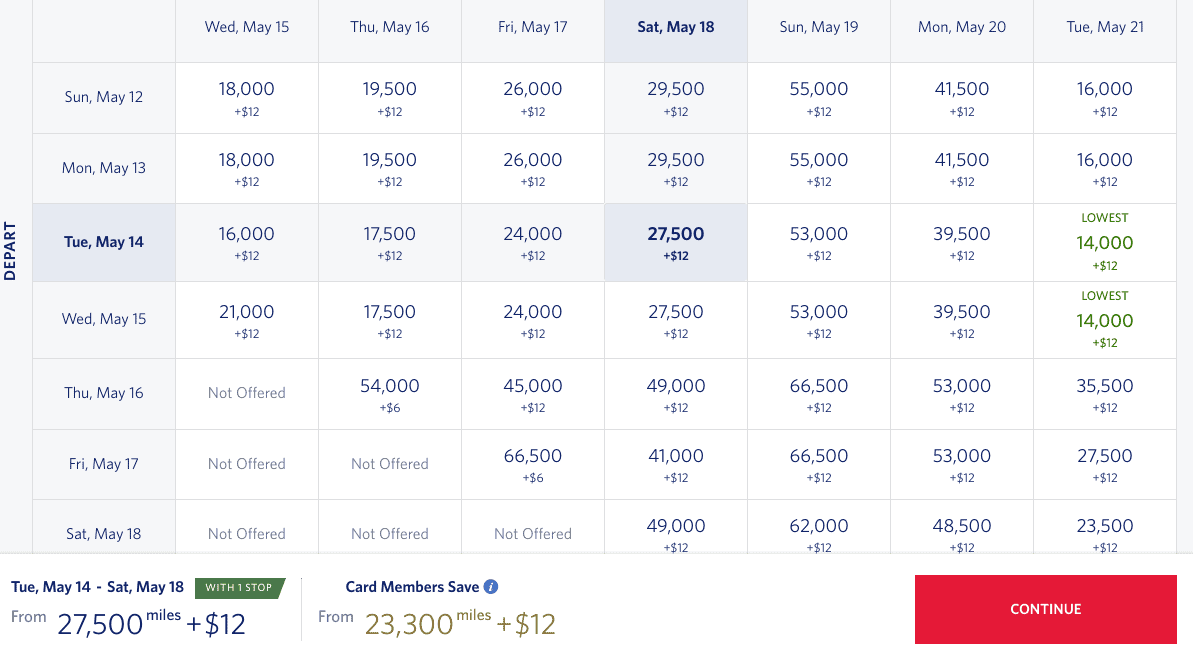

From there, you’ll be redirected to Delta’s calendar view which shows you all of the available award travel within a few days. When you click on a date, you can see the award rate for that day for normal SkyMiles members as well as for Delta-Amex cardholders (except Delta SkyMiles Blue cardholders)

Then, once you select the flight that you want to redeem SkyMiles for, you can proceed to the checkout page where you’ll see the TakeOff 15 discount automatically applied (as long as you qualify for the discount and you’re signed into your account).

Bear in mind that the discount doesn’t apply to taxes and fees and you must pay the taxes and fees with your eligible Delta SkyMiles Amex card in order to receive the discount. The discount also doesn’t apply to “Pay with Miles” or “Miles + Cash” rates or any upgrades or other services purchased after ticketing.

In some cases, you might save slightly more than 15% when using this benefit. In the following example, the rate for normal SkyMiles members would be 27,500 miles whereas the rate for Delta-Amex cardholders would be 23,300 miles.

If you apply a 15% discount to 27,500 miles, then the reduced price would be 23,375 miles. So, the actual discount in this case would be about 15.3%.

How to Apply TakeOff 15 to Existing Bookings

If you already have made several award bookings, then you may be able to save on these awards by signing up for a Delta co-branded credit card and then rebooking.

Let’s say you have an existing booking that cost you 150,000 miles and you don’t currently have a Delta co-branded credit card. If you’re interested in signing up for a Delta credit card, you can search your existing booking and see if the rate drops with the TakeOff 15 discount. In this case, the rate should drop to 127,500 miles (a discount of 22,500 miles).

If you want to reap those savings, you can sign up for one of the multiple eligible Delta credit cards, making you eligible for the TakeOff 15 discount. Then, you can cancel your existing reservation and rebook at the lower rate. However, it’s important to note that you should not do this if your existing booking is in basic economy class as basic economy awards are non-refundable. Award bookings in all other fare classes are fully refundable.

As a side note, even if you don’t qualify for the TakeOff 15 discount, it’s worth checking whether the price of your Delta award booking has changed. Since Delta SkyMiles uses a dynamic pricing model to price its award flights, there’s always a chance that the price of an award flight may change after you book it. In these cases, it may be smart to cancel your existing booking and rebook at a lower rate.

Which Delta SkyMiles Credit Card Is Right for Me?

When it comes to deciding which Delta SkyMiles credit card is right for you, you need to consider how high of an annual fee you’re willing to pay, your particular spending patterns, how likely you are to use each card’s other benefits and, of course, how often you fly with Delta.

To help you compare, the following table includes a basic overview of the three personal SkyMiles credit cards that include the TakeOf 15 benefit:

| Card name | Annual fee | Spending bonuses | Other benefits |

|---|---|---|---|

| Delta SkyMiles® Gold American Express Card | $0 introductory, then $150 | • 2X miles on Delta purchases, at restaurants and at U.S. supermarkets • 1X miles on all other eligible purchases | • Take up to $50 off the cost of your flight for every 5,000 miles you redeem with Pay with Miles when you book on delta.com. • $100 statement credit for vacation rentals or prepaid hotels booked through Delta Stays or delta.com • First checked bag free on Delta flights for cardmember and anyone else on your booking when you pay with your card • 20% back on in-flight purchases on Delta flights • Main Cabin 1 priority boarding |

| Delta SkyMiles® Platinum American Express Card | $350 | • 3X miles on Delta purchases and eligible hotel purchases • 2X miles at restaurants and U.S. supermarkets • 1X miles on all other eligible purchases | • Automatically receive $2,500 in Medallion Qualification Dollars each Medallion Qualification Year • Get $1 Medallion Qualification Dollar for each $20 in purchases you make on your card • $10 in monthly statement credits towards U.S. Resy restaurants (up to $240 annually) • $10 in monthly statement credits towards U.S. rideshare purchases with select providers (up to $120 annually) • Annual Companion Certificate usable on Main Cabin domestic, Caribbean or Central American round-trip flights (taxes and fees not included) • TakeOff 15 discount of 15% off Delta award flights booked through the SkyMiles program • Reimbursement fee credit for either Global Entry or TSA PreCheck • $150 statement credit for vacation rentals or prepaid hotels booked through Delta Stays or delta.com • Complimentary Hertz Five Star Status • First checked bag free on Delta flights for cardmember and anyone else on your booking when you pay with your card • 20% back on in-flight purchases on Delta flights • Main Cabin 1 priority boarding • Trip delay insurance (up to $300 per trip) |

| Delta SkyMiles® Reserve American Express Card | $650 | • 3X miles on Delta purchases • 1X miles on all other eligible purchases | • Automatically receive $2,500 in Medallion Qualification Dollars each Medallion Qualification Year • Get a $1 Medallion Qualification Dollar for each $10 in purchases you make on your card • Up to $20 in monthly statement credits towards U.S. Resy restaurants (up to $240 annually) • Complimentary Delta Sky Club access when traveling with Delta (plus four one-time guest passes) • Complimentary access to The Centurion lounge when traveling with Delta • Up to $10 in monthly statement credits towards U.S. rideshare purchases with select providers (up to $120 annually) • Enjoy a Companion Certificate on a First Class, Delta Comfort, or Main Cabin domestic, Caribbean, or Central American round-trip flight each year after renewal of your Card. The Companion Certificate requires payment of government-imposed taxes and fees of between $22 and $250 (for itineraries with up to four flight segments). Baggage charges and other restrictions apply. • TakeOff 15 discount of 15% off Delta award flights booked through the SkyMiles program • A reimbursement fee credit for either Global Entry or TSA PreCheck • Up to $200 statement credit for vacation rentals or prepaid hotels booked through Delta Stays or delta.com • Complimentary Hertz President’s Circle Status • First checked bag free on Delta flights for cardmember and anyone else on your booking when you pay with your card • 20% back on in-flight purchases on Delta flights • Main Cabin 1 priority boarding • Trip delay insurance (up to $300 per trip) • Trip cancellation and interruption insurance (up to $10,000 per trip and up to $20,000 per 12 months) |

All three of these cards include a variety of benefits, including the TakeOff 15 benefit, first checked bag free for anyone on your booking when you book with your SkyMiles credit card, a 20% rebate on any in-flight purchases on Delta flights and Zone 5 priority boarding on Delta flights.

Additionally, all three cards come with some standard travel benefits including the following:

- Baggage insurance plan up to $1,250 for carry-on baggage and up to $500 for checked baggage

- Car rental loss and damage insurance

- No foreign transaction fees

And, while the Platinum card and the Reserve card have much higher annual fees than the Gold card, these cards make up for those fees with premium benefits such as statement credits toward restaurant purchases with Resy, rideshare purchases with select providers (including Uber, Lyft, Curb, Revel and Alto), the application fee for either TSA PreCheck or Global Entry and hotel stays purchased through Delta Stays or delta.com.

Both the Platinum and Reserve also offer Companion Certificates on every cardmember anniversary, which allow you to add one companion to a round-trip domestic, Caribbean or Central American itinerary free of charge. However, while the Platinum’s Companion Certificate can only be used for tickets in the Main Cabin, the Companion Ticket provided by the Reserve card can be used on a First Class, Delta Comfort, or Main Cabin domestic, Caribbean, or Central American round-trip flight each year after renewal of your Card. The Companion Certificate requires payment of government-imposed taxes and fees of between $22 and $250 (for itineraries with up to four flight segments). Baggage charges and other restrictions apply.

Apart from that, the only major differences in the benefits offered by the Platinum and Reserve cards are that the Reserve card offers $10 more in monthly statement credits towards Resy, $50 more in annual statement credits towards Delta Stays and one higher tier in the Hertz elite status program. Additionally, the Platinum card offers undeniably better spending bonuses.

In our opinion, between these two cards, the Delta SkyMiles Platinum American Express card offers better value for its annual fee than the Delta SkyMiles Reserve American Express card. However, for those who want to pay a lower annual fee, the Delta SkyMiles Gold American Express card is a solid option that offers the TakeOff 15 benefit as well as $100 in statement credits, 20% back on in-flight purchases with Delta and free checked baggage allowance. These benefits can easily offset the card’s $150 annual fee (which is waived for the first year anyway, rates & fees).

If you’re a small business owner looking for a business credit card, then it’s also worth looking into one of the three Delta SkyMiles business credit cards that offer the TakeOff 15 benefit.

Is Using TakeOff 15 the Cheapest Way to Book Delta Award Flights?

Of course, using the TakeOff 15 benefit offered by the six Delta co-branded credit cards is the cheapest way to book any award flight through the Delta SkyMiles program. However, Delta flights are often offered at more affordable rates through other frequent flyer programs than through the Delta SkyMiles program. So, even with the TakeOff 15 benefit, is it still more affordable to book Delta flight through other programs? Let’s investigate.

Three of the best frequent flyer programs through which to book Delta-operated award flights are Air France-KLM Flying Blue, Korean Air Skypass and Virgin Atlantic Flying Club. So, let’s take a look at some examples from these programs when it might or might not make sense to book through Delta SkyMiles using the TakeOff 15 perk.

For instance, oftentimes, you can find cheaper domestic Delta flights through Air France-KLM Flying Blue than you would through the Delta SkyMiles program even if you have the TakeOff 15 benefit.

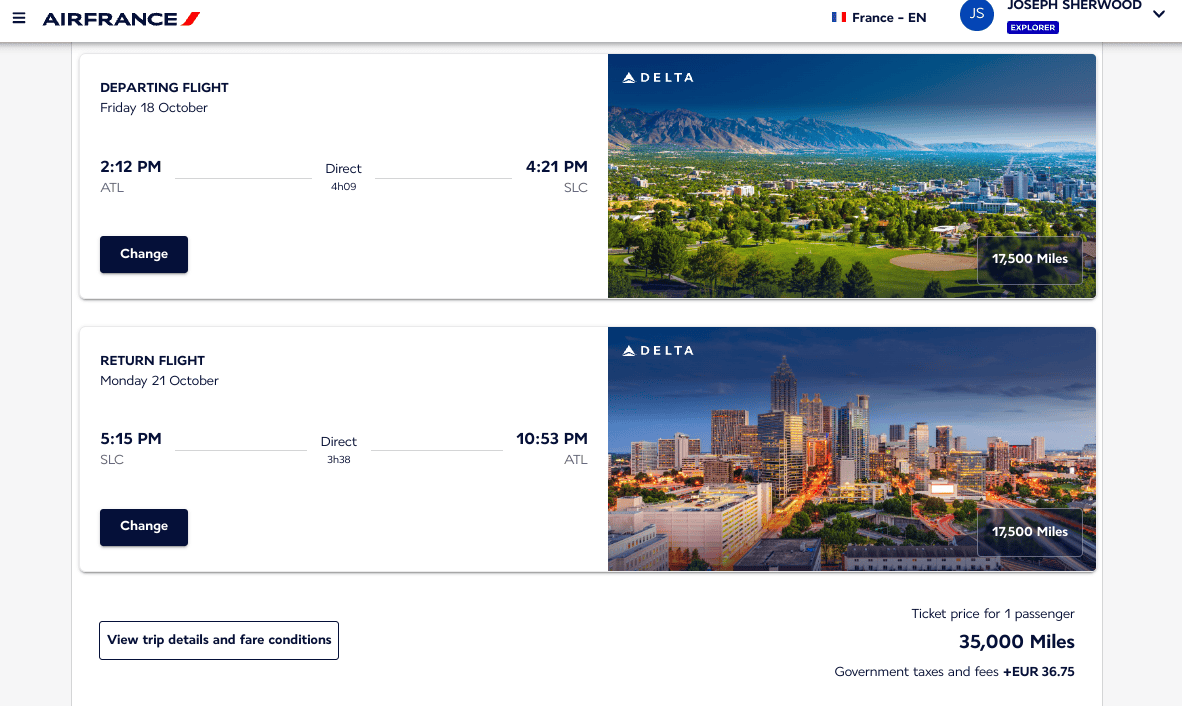

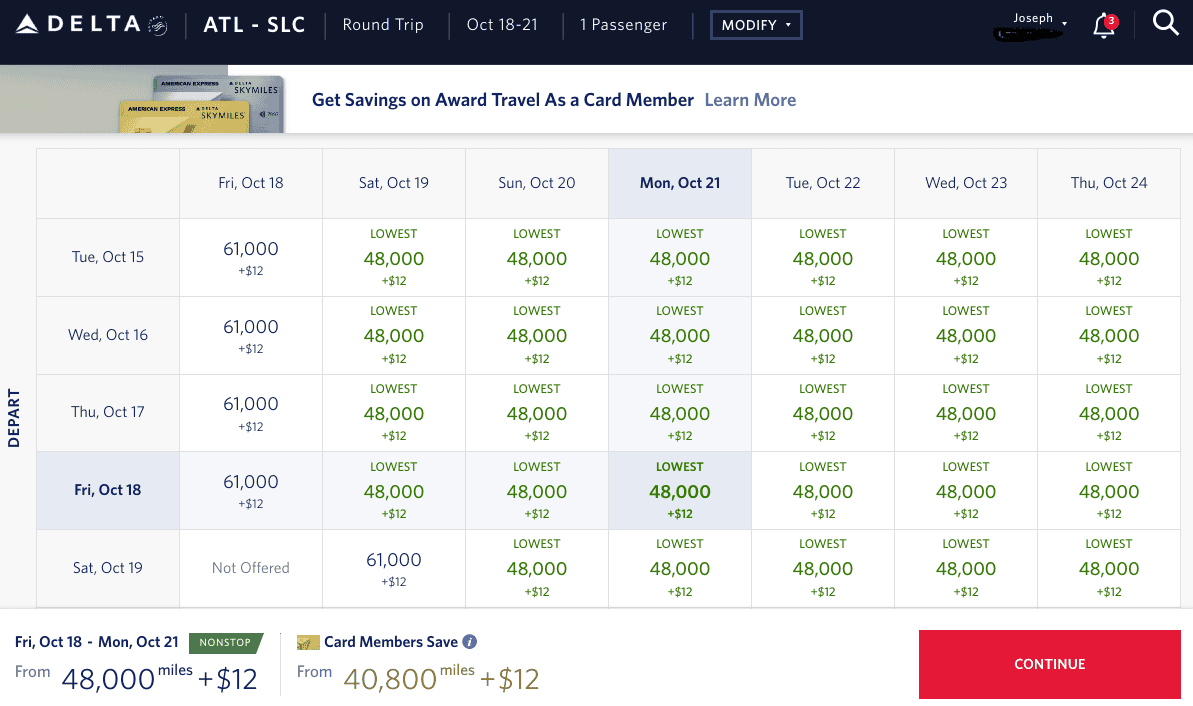

For example, we searched for a round-trip flight between Atlanta (ATL) and Salt Lake City (SLC) in Delta economy class through the Air France-KLM Flying Blue program and found an itinerary for 35,000 miles plus 36.75 euros ($39) in taxes and fees.

When we searched for the exact same flights on the same dates through the Delta SkyMiles program, we found that it would cost 48,000 plus $12 in taxes and fees without the TakeOff 15 benefit. So, if you don’t have a Delta co-branded credit card, you should book this flight through Flying Blue instead of SkyMiles (for instance, if you’re transferring from American Express Membership Rewards, which allows transfers to both Flying Blue and SkyMiles).

However, if you were to book this flight through SkyMiles and you did have the TakeOff 15 benefit, it would cost you 40,800 miles plus $12 in taxes and fees. In this case, even if you did have the TakeOff 15 benefit, you’d still be better off booking this flight through the Flying Blue program.

As in the previous example, even if you have the TakeOff 15 benefit, it’s often still cheaper to book Delta flights through other frequent flyer programs than to book them through the Delta SkyMiles program.

This applies mostly to American Express Membership Rewards members since this is the only major transferable credit card rewards currency that can be transferred to Delta SkyMiles and, thus, Amex Membership Rewards members are the only ones who have the option between transferring to SkyMiles or another frequent flyer program.

Of course, if you already have a large sum of miles in your Delta SkyMiles account, then you don’t have any good options other than to redeem those miles for Delta flights.

But, if you do have the option between transferring points to SkyMiles or transferring them to another frequent flyer program (as Amex members do), then you should check the rates offered by other programs (such as Air France-KLM Flying Blue, Korean Air Skypass and Virgin Atlantic Flying Club) for your desired flight before making a transfer.

You should be aware, though, that there are many instances when purchasing a Delta-operated award flight through the Delta SkyMiles program with the TakeOff 15 benefit (instead of through another frequent flyer program) is the best option available. So, while you should always check the different rates available to you through different frequent flyer programs, sometimes the best option will be to book that flight through the SkyMiles program using the TakeOff 15 perk.

The Bottom Line

With the TakeOff 15 benefit, Delta cardmembers (except Delta SkyMiles Blue American Express cardholders) can save 15% on Delta- and Delta Connection-operated award flights booked through the Delta SkyMiles program. This benefit can be applied to all future bookings made after you sign up for one of the eligible credit cards and can even be applied to certain existing bookings with the nifty workaround described above.

However, it should be noted that, even with the TakeOff 15 benefit, it’s still sometimes cheaper to book Delta-operated award flights through other frequent flyer programs (such as Air France-KLM Flying Blue, Korean Air Skypass and Virgin Atlantic Flying Club). So, if you were planning on transferring some Amex points to Delta SkyMiles to purchase a Delta award flight, you’ll definitely want to check the rates available from other frequent flyer programs first.

But, in many cases, using the TakeOff 15 benefit to get a discount on Delta award flights through the SkyMiles program is the best option. And this benefit is another reason why, if you fly with Delta often, you should definitely consider signing up for a Delta co-branded credit.

New to the world of points and miles? The Chase Sapphire Preferred® Card is the best card to start with.

With a bonus of 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening. , 5x points on travel booked through the Chase TravelSM Portal and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

Editors Note: Opinions expressed here are author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.