10xTravel is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This site may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the 10xTravel team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

Note: Some of the offers mentioned below may have changed or may no longer be available. The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. You can view current offers here.

The World of Hyatt Credit Card by Chase is Hyatt’s only commercial co-branded personal credit card. As you might expect, it naturally emerges as an exceptional choice for travelers who frequent Hyatt hotels and want to maximize their Hyatt stays. However, even occasional travelers have lots to gain from this card.

In this article, we’ll explore all the features and potential drawbacks of the World of Hyatt card. Should you ultimately decide to add it to your wallet, we’ll also reveal some interesting strategies to help you maximize its usage.

Chase World of Hyatt Card Overview

The World of Hyatt Credit Card is a hotel rewards card that offers a multitude of benefits primarily geared toward Hyatt loyalists. Here’s a look at the key features of this card.

Annual Fee

The World of Hyatt card costs $95 each year. Annual fees tend to dissuade many people from credit cards, but in this case, there are plenty of tangible benefits on this card that can help you offset this annual fee and then some.

Annual Category 1 to 4 Free Night Certificate

The World of Hyatt card comes with an annual free night certificate starting from your first cardmember anniversary. This means that after you own the card for 12 months, and every 12 months thereafter, you’ll get a free night at a Hyatt category 1 to 4 property.

In general, Hyatt hotels range from category 1 through 8, with 8 being the highest-end properties. While this does put a limit on the value of the category 1 to 4 free night certificate, it’s still a great benefit if you plan to stay at a Hyatt property at least once a year. You can easily find free nights at Hyatt category 1 to 4 hotels with cash rates ranging from $100 to $200 per night, and sometimes even upwards of $300 to $400 per night. This alone entirely offsets the annual fee.

Allow up to 10 weeks after your cardmember anniversary each year for the free night certificate to show up in your account. This free night certificate expires 12 months after being issued.

Welcome Offer

Historically, the welcome offer on the World of Hyatt card is structured as two separate tiers. The first tier is similar to a normal welcome offer, where you’ll earn bonus points after a certain amount of spend in the first three months. In the second tier, you’ll earn 2X points per dollar spent on purchases that normally earn 1X points, up to a certain spending limit.

The World of Hyatt Credit Card

Last call! Earn up to 5 free nights

Free Nights

Earn up to 5 free nights. Earn 3 free nights after you spend $5,000 on purchases in the first 3 months of account opening. Plus, 2 free nights after you spend $15,000 on purchases in the first 6 months. Free nights can be redeemed at any Category 1-4 Hyatt hotel or resort worldwide. Offer ends 9AM EST on 2/26/2026.

Annual Fee: $95

Earning Categories

The World of Hyatt card has the following bonus categories:

- 4X points on qualifying purchases at Hyatt hotels and resorts

- 2X points on dining, airline tickets purchased directly from the airline, gym memberships and local transit

- 1X points on all other purchases

These multipliers are nothing to write home about. This is especially true in the context of the other main Chase ecosystem cards, since Chase Ultimate Rewards points can be transferred to Hyatt. However, the 2X category on gym memberships stands out here as a category that appears on very few other cards, if at all.

When you get approved for this card, you’ll be enrolled as a World of Hyatt member if you aren’t one already. This means you can stack the 4X you earn on this card with the 5X base points you earn as a member. Effectively, you’re earning 9X on all Hyatt stays.

Foreign Transaction Fees

The World of Hyatt card doesn’t have any foreign transaction fees, so you can bring and use the card for international travel.

World of Hyatt Member Benefits

Of course, this card also comes with a number of benefits geared towards World of Hyatt members:

- Complimentary Discoverist status: This is the lowest status in Hyatt’s loyalty program. However, it does qualify you for benefits such as free daily bottled water, 2PM late checkout and potential room upgrades within the same category.

- Five elite-qualifying night credits each year: This gives you a headstart on earning Hyatt status for the next year. Typically, members earn Discoverist after 10 nights (World of Hyatt cardmembers get complimentary Discoverist), Explorist after 30 nights and Globalist after 60 nights. The Hyatt program also offers “checkpoint” rewards every 10 nights starting at 20 nights, so you’ll get a headstart there as well.

- Two elite-qualifying nights every time you spend $5,000 on the card: Technically, you can spend your way to Hyatt status with this card if you want. After every $5,000 in spending, you’ll get two qualifying nights. There’s no limit to how many qualifying nights you can earn with this method.

- Second free night after you spend $15,000 on the card: In addition to the free night certificate that comes with your membership after the first year, you can earn a second category 1 to 4 free night certificate after spending $15,000 on the card—once per cardmember per year. Allow up to four weeks after your cardmember anniversary each year for the free night certificate to show up in your account. This free night certificate expires 12 months after being issued.

These benefits are crucial if you plan on going for Hyatt status now or in the future. We’ll discuss this and other ways to maximize these benefits in a later section.

Other Card Benefits

You’ll get a few other important travel benefits with the World of Hyatt card:

- Purchase protection: When you use your World of Hyatt card for eligible purchases, the items are covered against damage or theft for a period of up to 120 days. Note that coverage applies to a maximum of only $500 per claim, and up to $50,000 per account.

- Extended warranty protection: If you make a qualifying purchase with a warranty duration of fewer than three years, the World of Hyatt card extends the warranty by an additional year.

- Trip cancellation and trip interruption insurance: This benefit offers reimbursement if your trip is canceled due to things like sickness or severe weather. Coverage is up to $5,000 per person and $10,000 per trip.

- Trip delay reimbursement: This benefit comes in handy if your travel is delayed by more than 12 hours or requires an overnight stay. Chase covers up to $500 per ticket for expenses such as meals and lodging.

- Lost luggage reimbursement: The World of Hyatt card covers up to $3,000 per passenger for check-in or carry-on luggage that’s damaged or lost by the carrier.

- Baggage delay insurance: If your baggage is delayed for over six hours, this benefit reimburses you for essentials like clothing and toiletries, up to $100 a day for five days.

- Secondary rental car collision damage waiver (CDW): This feature offers reimbursement for theft and collision damage for rental vehicles. Note that coverage provided by the World of Hyatt card is secondary. This means that your personal insurance takes precedence over this card’s CDW insurance.

Considering that the card only comes at a $95 annual fee, this is an impressive list of travel benefits in addition to the Hyatt-related perks.

Drawbacks of the World of Hyatt Card

While the World of Hyatt card offers many valuable benefits, it still has its drawbacks. Here are some important ones to consider before applying for the card:

- Hyatt-centric benefits: Hyatt loyalists are going to find a lot more utility out of this card than travelers who stay at a variety of hotels. If your loyalty lies with a different hotel chain, or you don’t anticipate yourself staying at many Hyatts in the future, you should avoid this card.

- Smaller footprint: Compared to hotel giants like Marriott and Hilton, Hyatt has a relatively smaller footprint. Fewer hotels means fewer choices, and thus fewer opportunities to use the benefits you get with this card. In fact, in certain regions and smaller cities, there may not be a Hyatt hotel altogether. If you demand more flexibility in your hotel choices, or frequently travel to locations without a Hyatt, this card may not be for you.

- Weak earning multipliers: The World of Hyatt card doesn’t really have strong earning multipliers on its own. This may not be a big problem in itself, especially if you have other Chase cards. But it does mean that, realistically, you’ll only be using this card to earn 4X at Hyatt purchases, and stashing it away for just about anything else.

We didn’t list the annual fee as a drawback, since it’s pretty easy to recoup that value with the category 1 to 4 free night certificate. Despite the other drawbacks, the World of Hyatt card still makes sense in most wallets, assuming you travel at least once or twice a year to Hyatt properties.

Alternatives to the World of Hyatt Card

If the drawbacks to the World of Hyatt card have you convinced it’s not the card for you, here are some alternatives you might consider:

- Marriott Bonvoy Boundless® Credit Card: With a much larger global presence, Marriott’s portfolio includes over 8,000 properties across more than 140 countries. This card also has a $95 annual fee and comes with an annual free night certificate. If you’re more of a Marriott loyalist, or simply want more options when booking hotel stays, the Bonvoy Boundless is a solid choice.

- Hilton Honors American Express Surpass® Card (Rates & Fees): Hilton also has a much larger footprint, with over 7,600 properties worldwide. This card comes in at a $150 annual fee, but has a number of tangible benefits, including a free night certificate and up to $200 worth of Hilton credits (up to $50 quarterly). This makes the Hilton Surpass card a great choice if you frequently stay at Hilton properties, but you’re leaving a lot of value on the table otherwise.

- Chase Sapphire Preferred® Card: With the same $95 annual fee, the Sapphire Preferred has the upper-hand in that it earns Chase Ultimate Rewards points, a more flexible currency that can be transferred to multiple travel partners. Hyatt is actually one of the transfer partners for Chase, so you can effectively earn Hyatt points with this card. If you want a travel card without being tied to a specific hotel chain, the Sapphire Preferred offers this flexibility.

- The World of Hyatt Business Credit Card: The business version of the World of Hyatt card is the only other co-branded Hyatt card. The personal World of Hyatt card is definitely catered towards a wider audience, since the free night certificate is easy to use, and it has a lower annual fee. By contrast, the business version has an annual fee of $195, and two $50 Hyatt credits semi-annually with no free night certificate. The business card earns bonus nights faster via spend, and offers Discoverist status to up to five additional employees. If these benefits sound appealing, this may be a suitable alternative for business owners. Other than that, it’s a weaker card compared to the personal World of Hyatt card.

Marriott Bonvoy Boundless® Credit Card

Earn 5 Free Nights

(each night valued up to 50,000 points)

after spending $3,000 on eligible purchases within 3 months of account opening with your Marriott Bonvoy Boundless® Credit Card. Certain hotels have resort fees.

Annual Fee: $95

Hilton Honors American Express Surpass® Card

130,000

Hilton Honors Bonus Points

after you spend $3,000 in purchases on the Card in the first 6 months of Card Membership.

Annual Fee:

$150

Chase Sapphire Preferred® Card

75,000

bonus points

after you spend $5,000 on purchases in the first 3 months from account opening.

Annual Fee: $95

World of Hyatt Business Credit Card

60,000

Bonus Points

after you spend $5,000 on purchases in your first 3 months from account opening

Annual Fee: $199

Maximizing the World of Hyatt Card

Now that we’re familiar with the basics of the World of Hyatt card, let’s discuss some advanced strategies to help you maximize the value of this card.

Using the Free Night Certificate

The easiest way to ensure to get value from this card is to use the free night certificate wisely. Think of it as spending $95 each year to get a free night at a Hyatt category 1 to 4 hotel. There’s some significant value up for grabs here, so let’s take a closer look.

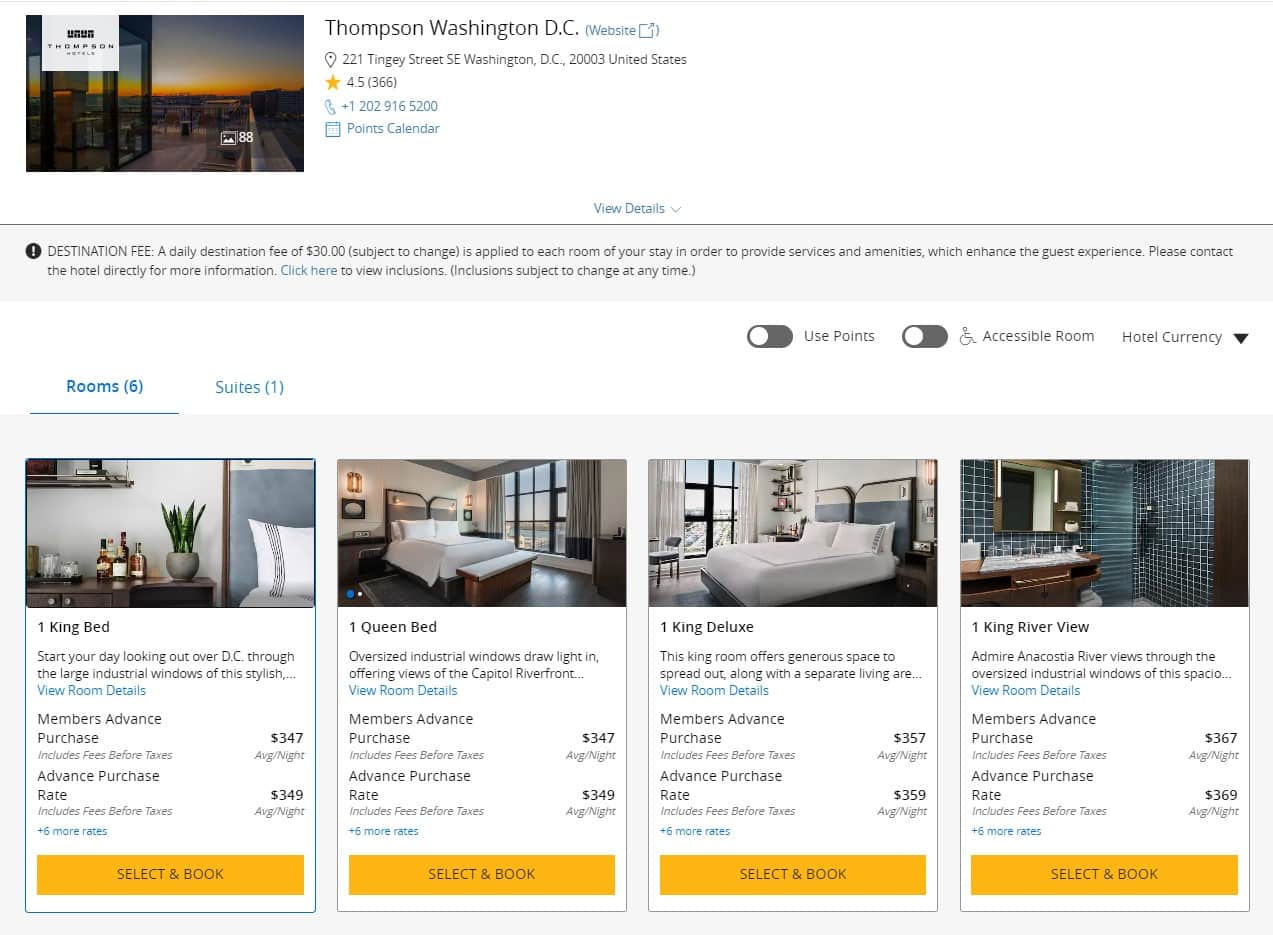

If you can, you should obviously aim for the category 4 Hyatts. These generally offer better value than the lower categories. For instance, the Thompson Washington D.C. is a category 4 hotel where 1 King Bed rooms often range between $200 to $400:

Here, the $347 1 King Bed room costs $402.34 total after taxes. Getting a $400 room for effectively $95 is a steal.

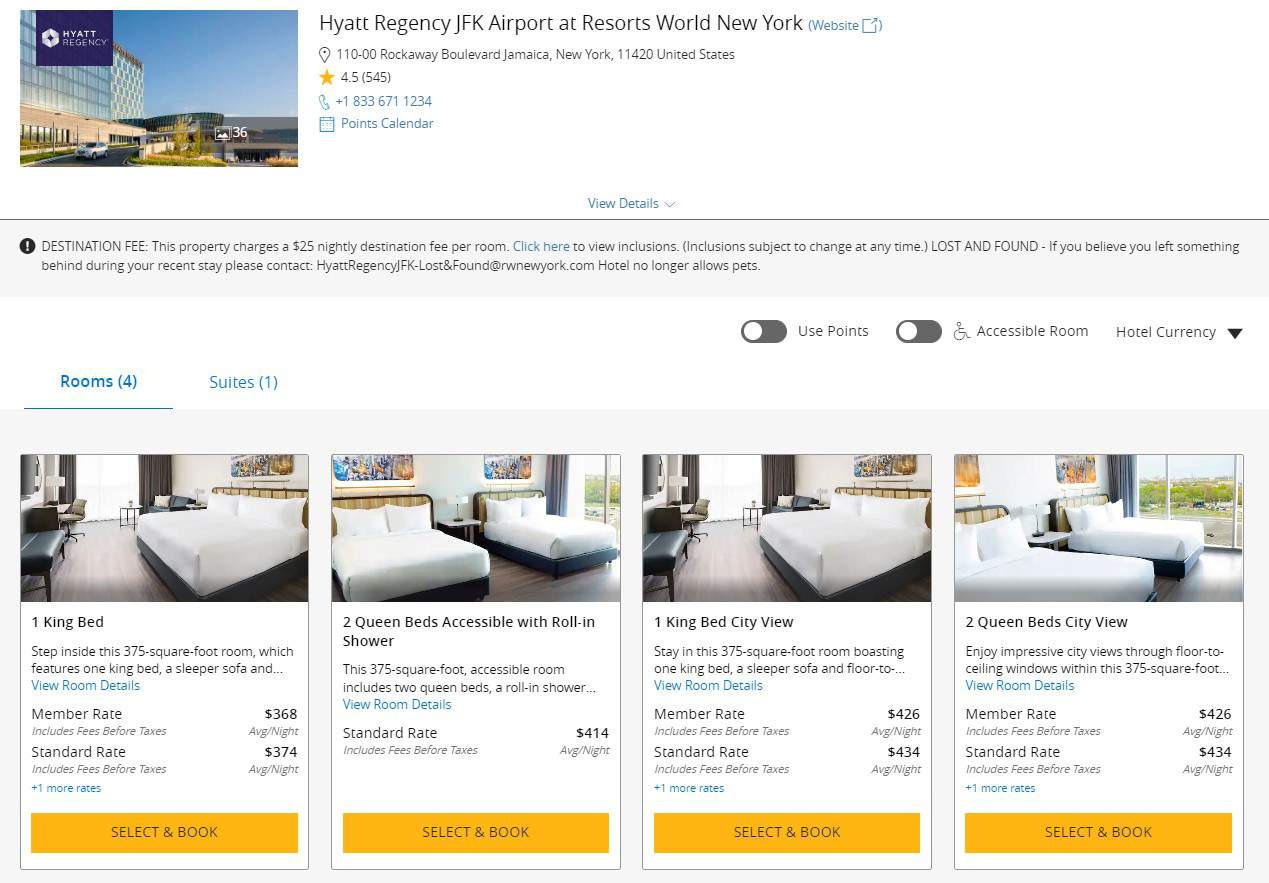

Or, consider the Hyatt Regency JFK Airport at Resorts World New York. This is a great hotel choice if you fly into JFK late at night and don’t want to spend extra on a night in the city. Best of all, this is a category 4 Hyatt, so you can use your certificate to get one night completely free. Room rates are upwards of $300 to $400 a night:

The $368 1 King Bed room costs $424.66 after taxes, so this is another brilliant use of your free night certificate.

If you do your homework, you’ll find plenty of Hyatts that can offer outsized value for the free night certificate. Just note that Hyatt tends to recalibrate hotel categories every year, which can push category 4 hotels to category 5 and above. This happened to the Manchester Grand Hyatt San Diego in early 2024. The Manchester Grand Hyatt used to be one of the best places to use the certificate, but sadly it’s now a category 5 Hyatt property.

Chase Ecosystem

If you plan on adding this card to your wallet, we highly recommend setting up a Chase ecosystem around it if you haven’t already. Here, “Chase ecosystem” refers to all of the cards that earn Ultimate Rewards points, such as the Freedom, Sapphire and Ink cards.

Why should you do this? Well, Chase is one of Hyatt’s few major transfer partners (another one is Bilt, but it’s usually a lot tougher to accumulate a large amount of Bilt points). This means that instead of having just your World of Hyatt card earn you Hyatt points, you can put all of your Freedom, Sapphire and Ink cards to work instead, and transfer them to Hyatt.

In fact, it’s very reasonable to prioritize a strategy where most or all of your Chase points are transferred directly to Hyatt. You generally get great value out of your Chase points this way, and it’s easy to dedicate other rewards currencies (such as American Express Membership Rewards or Capital One Miles) to the other programs if necessary.

By focusing your Chase and Hyatt credit card strategy this way, you can rack up a bunch of Hyatt points very quickly, earning you Hyatt hotel stays.

This strategy is also handy for Hyatt loyalists who want to earn Globalist status year after year. Ordinarily, you need 60 nights a year to qualify for Hyatt Globalist, although the World of Hyatt card gives you a five-night head start. Still, at 55 nights a year, that can cost a lot of money out of pocket unless a significant chunk of that is booked using points.

Catch-All Card Potential

The final strategy to maximize the World of Hyatt card is also the most interesting one, and that is to use it as a “catch-all card” up to the first $15,000 in spending each year.

When we think of “catch-all cards,” we usually consider cards like the Chase Freedom Unlimited® (1.5X Chase points on everything), Capital One Venture X Rewards Credit Card (2X Capital One Miles on everything) or Citi Double Cash® Card (2X points total: 1X points when you make a purchase, and 1X when you pay your balance). Why would the World of Hyatt card be a catch-all card?

Earn a $200

Bonus

after you spend $500 on purchases in your first 3 months from account opening.

Capital One Venture X Rewards Credit Card

Earn 75,000

Bonus Miles

when you spend $4,000 on purchases in the first 3 months from account opening, equal to $750 in travel

Annual Fee: $395

Citi Double Cash® Card

$200

cash back

after you spend $1,500 on purchases in the first 6 months of account opening. This bonus offer will be fulfilled as 20,000 ThankYou® Points, which can be redeemed for $200 cash back.

Consider what happens when you spend $15,000 on the World of Hyatt card. Here are all the rewards you get:

- 15,000 Hyatt points minimum, assuming this spending was in the 1X earning category

- One category 1 to 4 free night certificate

- Six qualifying nights toward Hyatt status

Let’s consider the value of each of these perks:

- 15,000 Hyatt points is conservatively worth around 1 cent per point, or $150 total.

- The category 1 to 4 free night certificate is conservatively worth between $100 to $200, or $150 on average.

- Six qualifying nights can be worth a lot if you’re aiming for Explorist or Globalist status, but we won’t attach a dollar value to it since it’s difficult to quantify.

At the very least, you’re getting $300 in value from the 15,000 Hyatt points and the category 1 to 4 free night certificate. In $15,000 of spend, a recouped value of $300 is a 2% return, which is the same or better than each of the catch-all cards we listed earlier.

However, this $300 figure is conservative. We previously illustrated how to maximize a category 1 to 4 free night certificate to get a value of around $400. Also, 15,000 points is the going rate for a standard night at a category 4 Hyatt. This equates to two nights at a $400 value for these rewards, totaling $800 in value for the $15,000 in spending. That’s a 5.33% return.

Of course, this strategy only works if you get a second free night certificate at $15,000 in spending per year. Past $15,000, you’re better off putting that spend elsewhere.

Final Thoughts

The World of Hyatt card has a very unique rewards structure that’s a must have for Hyatt loyalists, but also caters to frequent and occasional travelers alike. Overall, it’s an inexpensive travel card that pays for itself if you can take advantage of the annual free night certificate. You’ll come out even more ahead if you can implement any of the more advanced strategies to really maximize this card.

Whether or not you should apply for this card now depends on whether you’ll stay at a Hyatt property at least once each year. If so, the benefits on this card are definitely worth it, and even make this a long-term keeper card in your wallet.

New to the world of points and miles? The Chase Sapphire Preferred® Card is the best card to start with.

With a bonus of 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening. , 5x points on travel booked through the Chase TravelSM Portal and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

Earn up to 5 free nights. Earn 3 free nights after you spend $5,000 on purchases in the first 3 months of account opening. Plus, 2 free nights after you spend $15,000 on purchases in the first 6 months. Free nights can be redeemed at any Category 1-4 Hyatt hotel or resort worldwide. Offer ends 9AM EST on 2/26/2026.

Annual Fee: $95

after you spend $5,000 on purchases in your first 3 months from account opening

Annual Fee: $199

after you spend $500 on purchases in your first 3 months from account opening.

after you spend $5,000 on purchases in the first 3 months from account opening.

Annual Fee: $95

after spending $3,000 on eligible purchases within 3 months of account opening with your Marriott Bonvoy Boundless® Credit Card. Certain hotels have resort fees.

Annual Fee: $95

after you spend $3,000 in purchases on the Card in the first 6 months of Card Membership.

Annual Fee:

$150

when you spend $4,000 on purchases in the first 3 months from account opening, equal to $750 in travel

Annual Fee: $395

after you spend $1,500 on purchases in the first 6 months of account opening. This bonus offer will be fulfilled as 20,000 ThankYou® Points, which can be redeemed for $200 cash back.

Editors Note: Opinions expressed here are author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.