10xTravel is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This site may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the 10xTravel team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

Note: Some of the offers mentioned below may have changed or may no longer be available. The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. You can view current offers here.

All information about the Citi® / AAdvantage® Platinum Select® World Elite Mastercard® has been collected independently by 10xtravel.com.

Travel rewards can be a game-changer, but only if you know how to use them. The first step to becoming a pro at navigating the landscape of points is to understand that credit cards generally earn three main types of points: transferable points, fixed-value points, or direct airline miles or hotel points. Each type of point has its pros and cons, so it’s important to prioritize the right one for your needs.

In this article, we’ll break down these three types of points. After that, we’ll discuss our recommendations for which you should prioritize based on factors like your experience level with points and longer-term travel goals. Whether you’re aiming for a luxury vacation or simply want to stretch your points as far as possible, this guide will help you make the most informed decision on which points to pursue.

Transferable Points

Transferable points are the most flexible type of rewards currency you can earn with credit cards. As their name suggests, transferable points are points that you can transfer to different airline and hotel loyalty programs.

For earning transferable points, four major credit card issuers’ programs stand out:

If you’re looking to earn transferable points, start with one of these big four programs (probably Chase, due to the 5/24 rule). Alternatively, Bilt Rewards and Wells Fargo Rewards are two newer programs that also earn transferable point currencies. Note that it’ll be a little harder to accrue Bilt and Wells Fargo points due to the limited number of credit cards in their respective portfolios.

Certain loyalty programs also give you the ability to freely transfer points to partners. One prime example is Marriott Bonvoy.

With the transferable credit card points programs, you can move your points to partners like United Airlines, Hyatt or British Airways, often at a 1:1 ratio. This flexibility makes transferable points a favorite among savvy travelers who don’t want to be locked into earning a single airline or hotel chain currency.

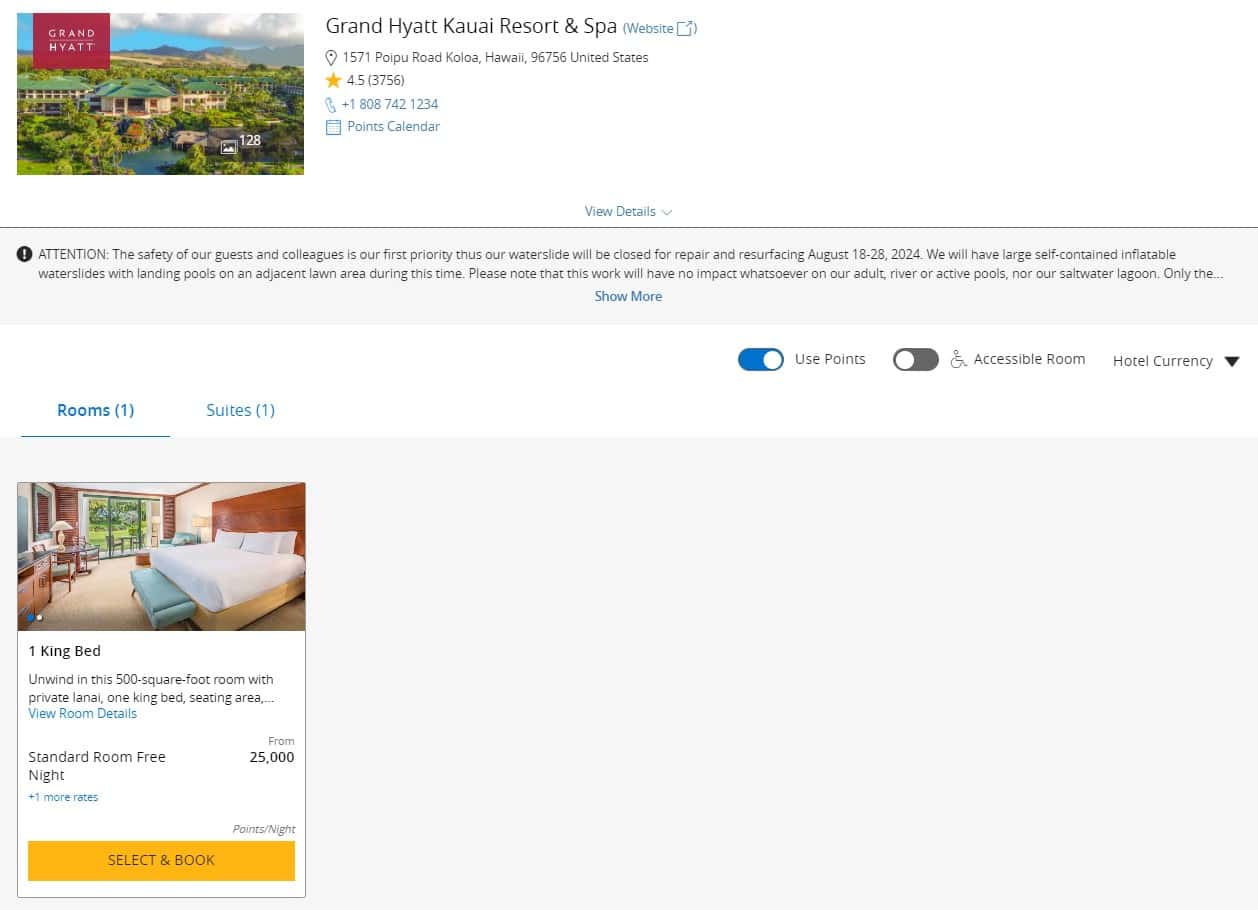

To give a concrete example, suppose you want to book the Grand Hyatt Kauai, often considered an aspirational property on the beautiful south coast of Kauai in Hawaii. During off-peak dates, one night will cost you 25,000 Hyatt points.

If you wanted to book three nights, that would cost 75,000 Hyatt points total. Rather than earn the 75,000 points directly through the Hyatt program, you can make use of transferable points. Since both Chase and Bilt list Hyatt as a transfer partner, you can transfer any existing Chase Ultimate Rewards or Bilt Rewards points directly to Hyatt. You can often make these aspirational redemptions much faster this way.

Advantages of Earning Transferable Points

Earning transferable points comes with numerous advantages, including:

- Flexibility: With transferable points, you can rack up a bunch of them first, and then decide what you want to do with them later. This gives you a lot more options when booking award travel.

- Transfer bonuses: Many programs offer periodic bonuses when transferring to specific partners. For example, the normal transfer ratio from American Express to British Airways is 1:1, meaning 1,000 Amex points converts to 1,000 Avios. During a 30% transfer bonus, 1,000 Amex points converts to 1,300 Avios. By taking advantage of transfer bonuses, you can stretch the value of your points significantly.

- Better protection from devaluations: Because you’re not locked into a specific airline or hotel loyalty program, your points are better protected from program devaluations. If a particular program stops being valuable, you still have a variety of other partners to transfer your points to.

Disadvantages of Earning Transferable Points

It’s important to highlight the disadvantages of transferable points as well:

- Transfers are irreversible: Importantly, once you initiate a transfer, this transaction cannot be reversed. For example, once you convert your Chase points into Hyatt points, they cannot be reverted back to Chase points.

- Complexity: To maximize the value of your transferable currencies, you’ll need to understand transfer partners, and more in-depth topics like award availability and point valuations. Researching the best ways to use your points can be time-consuming and may not appeal to those who prefer straightforward rewards.

Fixed-Value Points

Fixed-value points are straightforward and easy to use, making them a popular choice for those who prefer simplicity in their rewards strategy. Unlike transferable points, which can vary in value depending on how you use them, fixed-value points have a consistent value, usually tied directly to a specific dollar amount. For example, each point might be worth 1 cent, so 10,000 points would equal $100 in travel credits.

Two examples of institutions that provide fixed-value point currencies include:

- U.S. Bank

- Bank of America

For instance, U.S. Bank has no transfer partners, so points that you earn through cards like the U.S. Bank Altitude® Reserve Visa Infinite® Card have a fixed-value of 1.5 cents per point when redeemed for travel through the U.S. Bank online portal. It’s a similar story for Bank of America, where points are worth 1 cent per point.

Technically, all of the programs that we listed in the transferable currencies section could also be redeemed as fixed-value currencies. For example, you have the option to redeem your Chase Ultimate Rewards points through the Chase Travel portal. With the new Points Boost program, this value is now dynamic. If you hold the Chase Sapphire Preferred® Card. you can get up to 1.75x value on select premium flights and hotels. If you have the Chase Sapphire Reserve®, that potential value is even higher, with redemptions worth up to 2x on select bookings. While this isn’t always the most optimal way to use your Chase points compared to strategic transfers, it’s a much more straightforward way to get the redemptions you want at a decent value, without going too deep into the various points and miles rabbit holes.

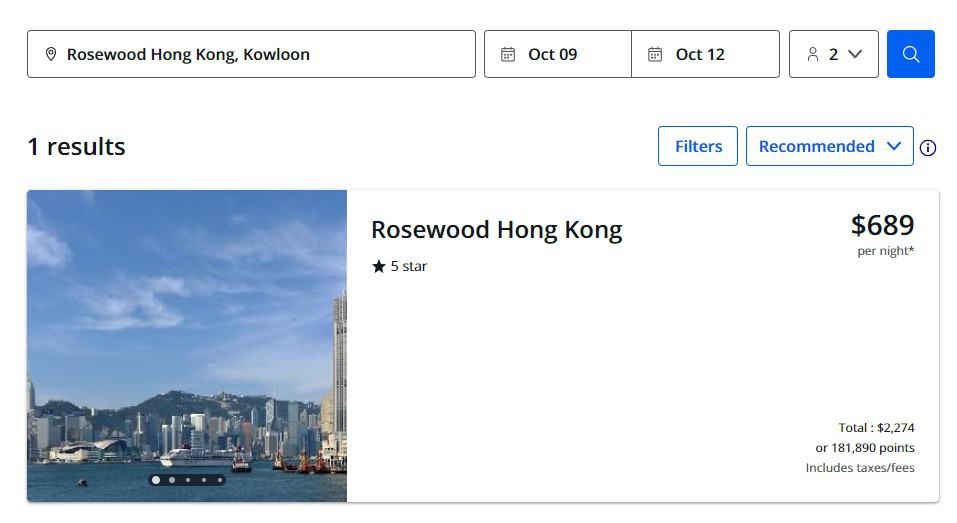

In addition, using your fixed-value points via a travel portal can provide greater flexibility in the type of redemptions you can make. For example, suppose you wanted to book a stay at the Rosewood Hong Kong, a property that isn’t part of any of the major hotel chains. You can still make that booking using points in the Chase travel portal. The number of points required would depend on the cash price of the stay and whether it’s eligible for a Points Boost offer, but it provides a simple way to book travel that isn’t available through transfer partners.

Is this the greatest redemption value? Definitely not, but there isn’t really any other way to easily use points to book the second best hotel in the world according to The World’s 50 Best Hotels 2024 list.

Advantages of Earning Fixed-Value Points

Earning fixed-value points can come with the following advantages:

- Simplicity: Fixed-value points are easy to understand and use. You know exactly what your points are worth, and you never have to worry about transfer ratios, bonuses or even award availability.

- Flexibility: While you can’t transfer to loyalty programs, you can use your points to cover an even wider range of travel-related expenses compared to transferable points. For example, you can potentially make award redemptions for experiences that aren’t usually covered by the typical transfer partners, such as boutique hotels or budget airlines.

- Stable value: You can rest assured knowing that the value of your points won’t fluctuate based on how or where you redeem them. Fixed-value points typically go through fewer devaluations than most other airline and hotel loyalty programs’ points.

Disadvantages of Earning Fixed-Value Points

Take note of the following disadvantages of fixed-value currencies:

- Lower potential value: Unlike transferable points, which can sometimes be redeemed for outsized value through strategic transfers, fixed-value points are locked into their set value. This greatly limits the potential for finding exceptional deals.

- Lack of transfer options: For rewards programs offered by U.S. Bank and Bank of America, your fixed-value points can’t be transferred to other programs. This can limit your options if you’re looking to leverage points for luxury travel or first-class flights.

- Potentially higher prices via travel portals: Anecdotally, many travelers report that booking a flight or hotel stay in a travel portal is much more expensive than booking directly with the airline or hotel. Because you’re stuck using these travel portals if you only have fixed-value points, this can further reduce the value of your rewards.

Airline Miles and Hotel Points

The final category of credit card programs are those that directly earn airline miles and hotel points. These points and miles are tied to a particular brand, such as American Airlines AAdvantage or Marriott Bonvoy. When you earn these rewards, you’re accumulating them for future travel with that specific airline or hotel chain.

The credit cards that offer airline miles or hotel points are co-branded with a bank issuer. For example, Citi offers the Citi® / AAdvantage® Platinum Select® World Elite Mastercard®,which earns AAdvantage points, and Chase offers the Marriott Bonvoy Boundless® Credit Card, which earns Marriott points. Usually, the earning multipliers on these co-branded cards are strong when making purchases related to that brand.

As you might expect, cards that directly earn a specific loyalty program’s currency are great if you’re already a frequent user of that program. However, because these awards are limited to the offerings of that program, they aren’t as flexible as the other two currency types.

Advantages of Directly Earning Airline Miles and Hotel Points

Here are some advantages of cards that directly earn airline miles and hotel points:

- Higher multipliers with the brand: A co-branded credit card usually has better earning rates when you make purchases related to the brand. This can help you quickly rack up your favorite loyalty program’s currency, which is a huge plus if you frequently travel with that program.

- Exclusive perks: Many co-branded credit cards come with perks like free checked bags, priority boarding, room upgrades or complimentary elite status.

- Direct access to exclusive programs: Some airline or hotel programs, like American Airlines AAdvantage, aren’t transfer partners with any of the major bank rewards programs. By using their co-branded cards, you can directly earn AAdvantage miles, giving you quicker access to rewards that might otherwise be hard to accumulate.

Disadvantages of Directly Earning Airline Miles and Hotel Points

Be aware of the following disadvantages if you prioritize cards that directly earn airline miles or hotel points:

- Limited flexibility and versatility: The rewards you earn are tied to a specific brand, so you’re locked into redeeming them within that brand. Unlike transferable points, you can’t move your points to another program, which limits your ability to take advantage of other loyalty programs’ benefits.

- Blackout dates and limited availability: It may be difficult to work around the program’s blackout dates or limited award availability if you don’t have the ability to transfer and use your points elsewhere. This is especially true during peak travel times.

- Devaluation risk: Loyalty programs are always subject to changing their award pricing, sometimes without much notice. This can quickly devalue the points and miles you’ve accrued.

So Which Type Should I Prioritize?

Let’s summarize the pros and cons of all three currency types:

- Transferable points are flexible and offer incredible value, but require you to do your research to maximize their potential.

- Fixed-value points are easy to use and even more flexible than transferable points, but the trade-off is that their value is capped.

- Airline miles and hotel points are the most inflexible of the three, but they can still be incredibly valuable if you’re a loyal member of one particular program.

Remember these three simple guidelines when you are deciding which points to prioritize in your points and miles journey.

For example, if you’re a beginner who’s just getting started with points and miles, start with transferable points currencies for the greatest amount of flexibility. When it comes time to redeem your rewards, you can transfer them to partners if you have a specific redemption in mind or want to chase outsized value. If not, there’s a plan B: you can always redeem them as fixed-value points.

If you’re a more intermediate or advanced points and miles enthusiast, you might already have a lot of transferable points. You might also be more familiar with what redemptions you want to target, and the points you need to earn to get there. If this is the case, then you might consider more cards that directly earn airline miles and hotel points for your chosen loyalty programs to complement your existing transferable points.

In all cases, it’s helpful to consider your travel habits and goals. If you’re already an elite member with a particular airline or hotel program, you might want to double down on that by applying for cards that earn their currencies. If you have a specific redemption in mind, you can apply for cards that earn either transferable or direct points to help you make that booking.

If we could only choose one type of currency to prioritize for the majority of people, it would be transferable points. This type of points gives you the best chance of landing a luxurious, aspirational travel experience that you might otherwise have to pay an astronomical cash rate for.

Transferable points also maximize value without sacrificing flexibility. When it comes time to book your dream vacation, having the ability to transfer points to different airlines can make the booking process much easier. If one program doesn’t have award space, there’s a chance another transfer partner can come through for you.

Final Thoughts

Choosing the right type of points to focus on depends on your travel goals, preferences and experience. Transferable points offer unmatched flexibility and value, fixed-value points provide simplicity and predictability, and airline miles and hotel points can boost your rewards balance with a particular loyalty program.

While we recommend prioritizing transferable points for the majority of travelers, there’s no one-size-fits-all answer. Whatever your choice, understanding the strengths and weaknesses of each type is crucial to help you make the most of your travel rewards.

New to the world of points and miles? The Chase Sapphire Preferred® Card is the best card to start with.

With a bonus of 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening. , 5x points on travel booked through the Chase TravelSM Portal and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

Editors Note: Opinions expressed here are author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.